IPC: Chinese e-commerce exports – especially from Temu – have significantly increased in the past three years

The 2025 edition of the IPC Cross-Border E-Commerce Shopper Survey has been released today, providing a comprehensive overview of online cross-border consumers’ expectations and habits. The survey was conducted in September 2025 with 30,970 participants from 37 countries worldwide.

IPC’s CEO, Holger Winklbauer said: “The 2025 Cross-Border E-commerce Shopper Survey shows that consumer confidence in cross-border e-commerce remains high. Chinese e-commerce exports – especially from Temu – have significantly increased in the past three years, though the global e-commerce supply chain is evolving due to customs changes in 2025 and into 2026. At a time when new customs and handling charges are being added, consumers reiterated the importance of having clarity on the fees prior to their purchases”.

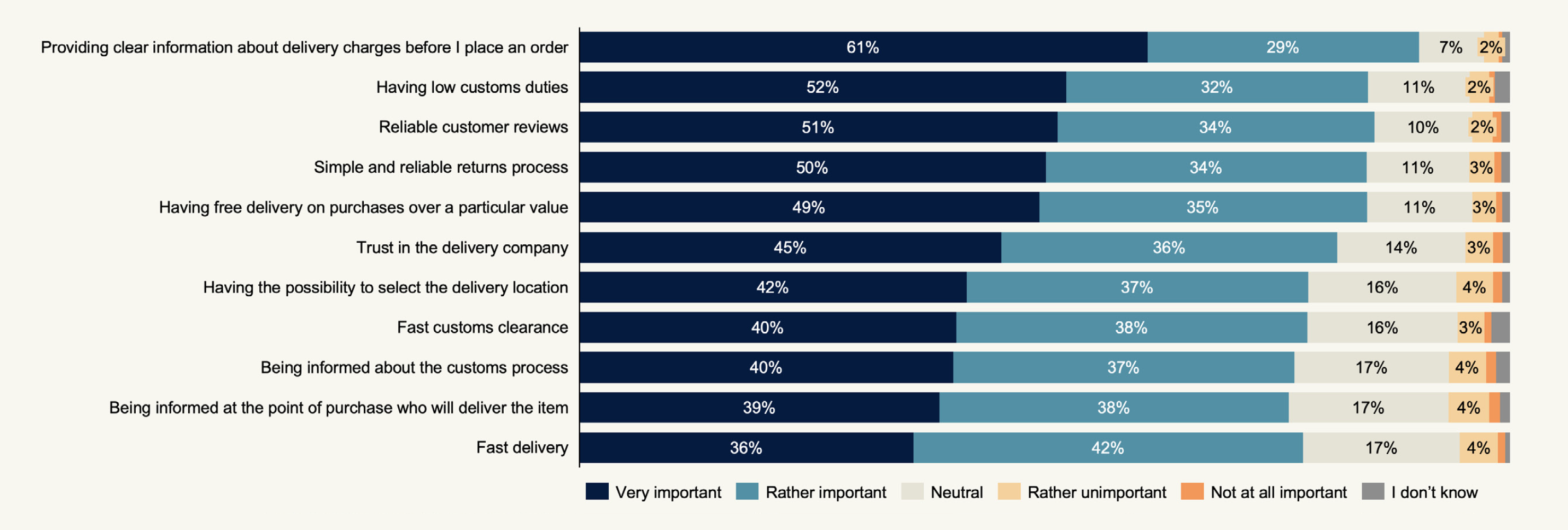

Clear information on delivery charges pre-purchase is most important for online shoppers

When buying online from another country, clear information on delivery charges pre-purchase is essential for 61% of consumers. Approximately half of respondents consider that low customs duties are essential as well as reliable customer reviews.

Temu has rapidly risen to match Amazon’s cross-border e-commerce market share

Chinese general e-retailer Temu has increased its cross-border e-commerce share from less than 1% in 2022 to 24% in 2025, becoming the most used cross-border e-retailer alongside Amazon. Shein, despite explosive growth in 2020-23, has a stable market share in the past two years. Between 2018 and 2025, Wish lost 95% of its share, eBay lost 68% and AliExpress lost 33%.

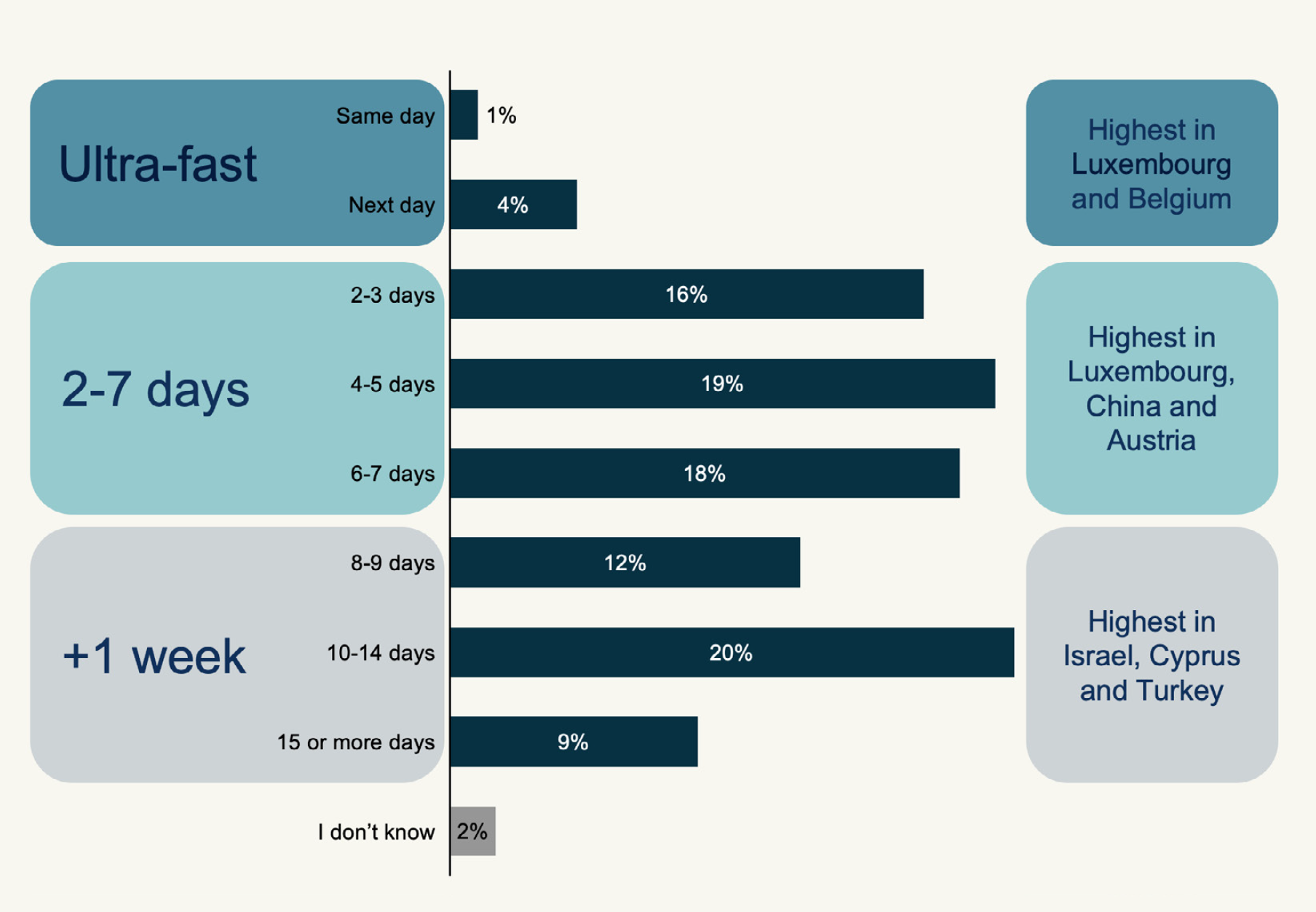

Delivery took 2-7 days for over half of all cross-border orders

Respondents were asked how long the delivery took, from buying the product online until the order was delivered. The most common transit times were 4-5 days (19%) and 10-14 days (20%). Delivery was usually fastest for consumers in countries who mainly buy from neighbouring countries, while delivery was slowest for those primarily buying from more distant markets. The proportion of parcels taking 15+ days decreased sharply from 29% in 2020 to 7% in 2025.

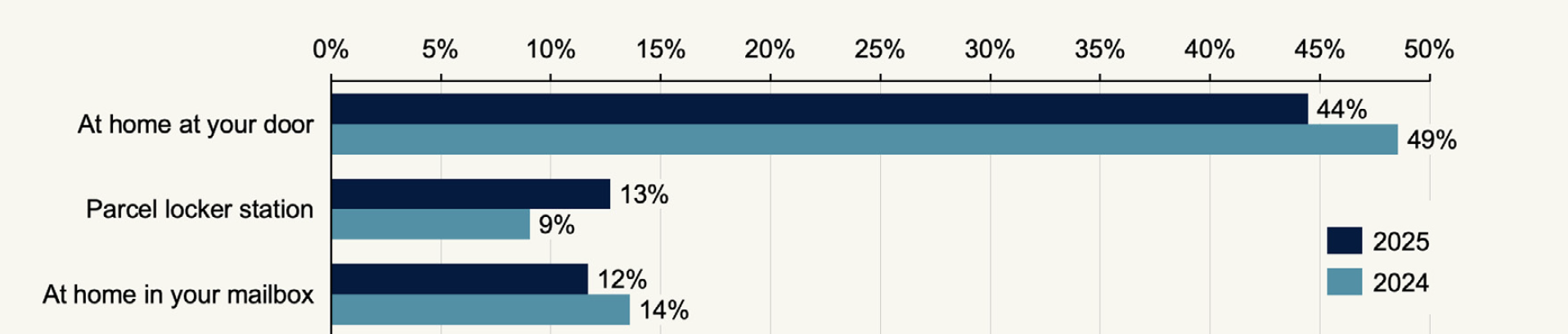

Doorstep delivery is most common, though Parcel Lockers are

on the rise

on the rise

Doorstep delivery was used by 44% of respondents for cross-border delivery, followed by Parcel Lockers (13%) and delivery direct in the Mailbox (12%). Lockers increased significantly in usage in 2025.

To download the key findings from the research, go to http://www.ipc.be/shopper