Spain's stock market reglatory body is taken to court

Hacienda has started a crackdown on the use of 500 euro notes in Spain. The notes, known popularly as ‘Bin Ladens’, because everyone knows they exist, but nobody has seen one, now represent 67.1% of the total cash in circulation in Spain. More than quarter of all the 500 euro notes in existence are in Spain. Now banks and security companies have been obliged to inform Hacienda about the movement of the notes and the Agencia Tributaria has announced it is to call those who have taken part in 2,100 deals involving more than 1,000 of the notes. Most of the deals, detected at the end of last year, are from the real estate sector.

Meanwhile Hacienda says they are planning to pay 10.48 billion euro in income tax rebates this year, 5.5% more than last year. The number of tax payers in Spain is up by just over 5% this year at 17 million 620,000.

British Airways has said that it will hold talks to try and create an alliance for the purchase of Iberia airlines, but the British company has ruled out acting alone. Some of the people being approached to take part are reported to be Spanish. It follows interest shown in Iberia by the risk capital group Texas Pacific. BA currently has 10% of the Iberia shares.

The management of the CNMV, the regulatory body for the Spanish Stock Market, has been denounced by SICAV, an investment company, for alleged perversion of the course of justice and bribery. The case is against the entire executive committee of the regulatory body, including the President Manuel Conthe, who is expected to announce his resignation to Congress tomorrow.

The case alleges that the CNMV archive a previous complaint against the Banco Sabadell without reason.

The French/Spanish tobacco giant Altadis has repeated its rejection of an approach from Imperial Tobacco based at 47 euro a share. A statement describes Imperial as opportunist following poor results for 2006, caused they say temporarily because of exceptional measures from the Spanish taxman.

There was another demonstration in Madrid on Sunday on the anniversary of the collapse of the Forum and Afinsa stamp-trading companies in Spain. Thousands of people have lost their life savings in the cases – organisers put the number at 460,000. They claim the state has been negligent in its legislation between 1979 and 2007.

And finally,

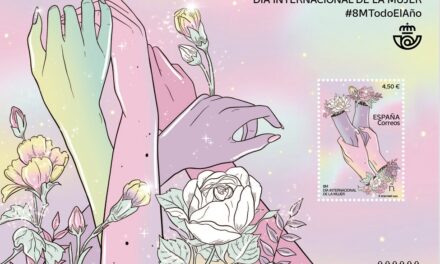

New regulations mean that Correos, the Spanish post office, will be penalised in the future if deliveries are late. The new rules demand that 93% of letters need to be delivered within three days of posting. In fact the plan will see a reduction in the grants paid by the Development Ministry to Correos, if the targets are not met.