Excerpt from UPU’s Development strategies for the postal sector: an economic perspective

Methods of Delivery

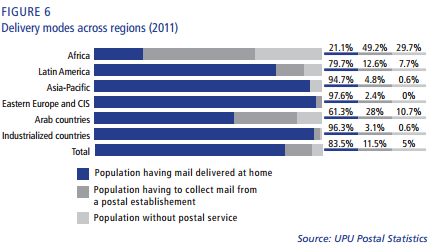

In total, 83.5% of the world’s inhabitants have mail (mostly letters) delivered at home, 11.5% collect their mail from a postal establishment, and only 5.0% are without access to postal delivery services. This high rate of penetration has not changed substantially over time.

Retail Network Strategies

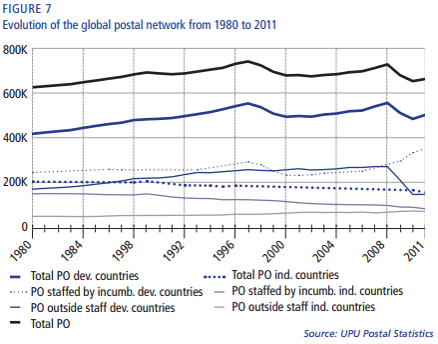

The number of permanent post offices increased slightly between 1980 (around 630,000) and 2011 (660,000). The upper curve in figure 7 shows that the evolution in the number of post offices over the past three

decades has not been smooth. The number of permanent post offices reached a peak of 740,000 in 1997, and then declined until the beginning of the 21st century. It then increased to almost 730,000, before falling once again to its current level of around 660,000.

In industrialized countries, there has been a clear trend over the past 30 years to transform post offices managed by the

incumbent’s own staff into post offices managed externally, often through a franchising model enabling fixed-cost sharing with other services. The total number of permanent post offices managed by the Post’s own staff thus declined from 205,000 to 160,000.

The trend has been rather different in developing countries: not only has the total number of permanent post offices increased from 420,000 to 500,000.

Post offices are increasingly being used as agency contact points for private partners in the provision of a range of financial services. Operators are also leveraging their networks to distribute their own financial services.

Postal Infrastructure

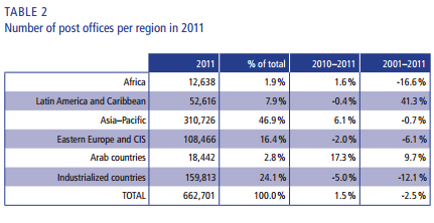

In 2011, the number of post offices increased globally by 1.5% but decreased significantly in industrialized countries (-5.0%). At the end of 2011, the total number of post offices stood at 662,701. Of that total, 439,376 were staffed by officials of the incumbent operator, and 223,325 were managed by people from outside the incumbent operator.

Financial Results

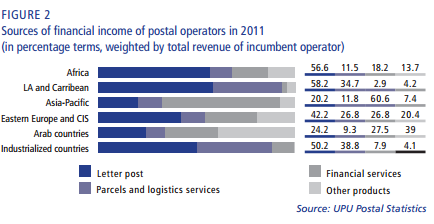

The global aggregated revenues (in nominal terms) of all incumbent operators decreased by 3.1% in 2011. Letter post is still providing the lion’s share in terms of income, but other products and segments are gaining ground.

For 2011, the biggest share of financial income of all incumbent operators stemmed from the letter-post business (48.3%).2Parcels and logistics services constituted the second largest source of income (34.6%). The third was postal financial services (11.7%), and other products came fourth (5.3%).