A Dialogue with Helge Israelsen, CEO of Post Danmark

Mail & Express Review May 2009 Recently the Editor of Mail & Express Review had the opportunity to discuss with Mr Israelsen current developments at Post Danmark, including its planned merger with Sweden Post, Posten AB. We began by asking for some background information on his organisation.

PLEASE PROVIDE SOME CONTEXT FOR OUR DISCUSSION. WHAT ARE SOME OF THE KEY FACTS AND FIGURES ABOUT POST DANMARK?

Post Danmark performs an important social service. Six days a week, in all areas of Denmark, Post Danmark sorts and distributes 3.8m letters, 7.3m magazines, newspapers and unaddressed items, and around 200,000 parcels. We deliver to 2.6m households and 280,000 businesses.

Operationally we have four mail sorting centres, two parcels centres, and 309 distribution locations.

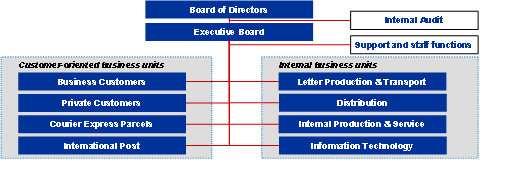

Post Danmark has a decentralised organisation defined by individual business units with clear responsibility for performance and profit and loss. In total there are eight units as detailed below:

In 2008 Post Danmark experienced revenue growth, which resulted in a profit after tax of DKK965m compared to a profit of DKK71m in 2007. However, the operating profit (EBIT) dropped sharply in the fourth quarter of 2008 compared with 2007.

HOW ARE YOU REGULATED?

Post Danmark has to comply with a general act regarding postal operators, and a concession for Post Danmark, with the following rules:

- Nationwide basic services of a uniform standard including uniform prices and a price ceiling model; delivery of mail six days a week; and a minimum quality standard of 93 per cent.

- Other postal service providers may, on payment, obtain access to Post Danmark’s address database for information in relation to the “Ingen reklamer, tak” (‘No unaddressed mail, thank you’) scheme and change of address information.

- The post has the exclusive right to set up letter boxes in public places; and to issue stamps bearing the name “Danmark”.

The Universal Service Obligation is defined as addressed mail up to 2kg, newspapers, magazines, registered and insured (except business to business) up to 20kg, and items for the blind up to 7kg. The reserved area is domestic letters up to 50g.

WHAT IS ONE OF YOUR BIGGEST STRATEGIC CHALLENGES?

Post Danmark’s most significant strategic challenge is the falling volume of letters. Over the last ten years the volume of letters has fallen by about 25 per cent. During the same period there has been a significant rise in unaddressed mail.

Electronic substitution and changes in customer habits are having a significant effect on Post Danmark’s sales. The declining volume of letters is affecting profitability and prices. The current economic recession is accentuating this effect. Post Danmark has so far been able to counteract this by adapting its resources.

SCANDINAVIAN COUNTRIES ARE PARTICULARLY NOTED AS EARLY ADOPTERS OF NEW AND EMERGING TECHNOLOGIES. PRESUMABLY POST DANMARK REFLECTS THIS CULTURE IN ITS OPERATIONAL AND PRODUCT STRATEGIES.

Post Danmark is a hi-tech company, and handling processes are organised with a view to optimising the level of automation, so that distribution can proceed as quickly and rationally as possible.

Post Danmark’s production and distribution are based on the intelligent, innovative use of electronic data. We regard ourselves as pioneers in this field. The electronic data flow in association with the physical flow is a prerequisite for modern, efficient handling of post. Post Danmark’s databases form the core of our production planning system: from customer order to sorting process, planning of routes, staffing and delivery frequency.

With the intelligent use of electronic data we have created an efficient production and distribution system. Most letters are sorted on OCR machines which sort directly to the individual distribution routes using data from the databases for Recipients, Production Data and Moves/Customer Service/Magazine Adjustments.

Time critical mail is produced and distributed on a daily basis, and non time critical mail is produced and delivered to individual recipients once every two days. Redirecting to a new address takes place automatically without the mail being delayed.

Post Danmark has also established Data Scanning and e-Box, which is a secure electronic P. O. Box where a customer can receive and store documents that are normally received by post. Related to this, companies are offered the facility of sending letters as electronic communication.

HOW WELL PREPARED ARE YOU FOR FULL LIBERALISATION IN THE LETTERS MARKET? DO YOU HAVE ANY SIGNIFICANT DOMESTIC COMPETITORS AS YET?

Like most other EU member states, Denmark is currently in the final phase of liberalisation of its postal market, although most of Post Danmark’s sales are already generated in free competition.

In 2007 Posten Norge (Bring CityMail) set up a business in Denmark to distribute letters and magazines from major senders in selected areas of the country. As Bring CityMail is not subject to the USO, it chose only to distribute post in the most densely populated areas of Copenhagen and Northern Zealand.

Full liberalisation of the letter market means that in future there will be even tougher competition in areas that previously only involved letters over 50g, as well as parcels, magazines and unaddressed mail. A number of major international postal and logistics companies are already established in Denmark.

The basic principle of delivering post in Denmark is a unit rate system, in which everyone pays the same price to have a given item of mail delivered. There are, however, significant differences in the costs of various kinds of letters and franking, and there is also a major difference in the costs of handling large batches of letters designed for mechanical reading compared to individual items. As liberalisation proceeds, prices will of course rise for the most expensive products, especially private letters.

The model for liberalisation of the Danish market for postal services aims to achieve a balance in which, on the one hand, citizens and companies continue to enjoy benefits with regard to price, range of services and quality, and on the other hand, the conditions for all postal companies are identical. This will guarantee the retention of a very efficient, effective postal service in Denmark while continuing to fulfil the duty to provide national coverage.

In this regard, competitors will only move into the lucrative part of the market, that is business customers with industrial post. This means, for example, that private customers and small businesses that are not profitable to service will be left to Post Danmark. Competitors will only serve the densely populated areas of the country.

CAN WE LOOK AT THE PARCELS MARKET? WHAT IS HAPPENING IN B2B and B2C?

The Danish parcels market has always been open to full competition, with both domestic and international providers.

Post Danmark is market leader in the B2B parcels market and well positioned, delivering a top quality service. The standard delivery service for parcels on the Danish domestic market is next day, and most companies therefore compete by offering delivery the day after ordering. This makes the distributor an integrated part of the company’s delivery promise.

In the current economic recession in Denmark, and globally, it is our experience that the market for B2C parcels is less affected than B2B. In future the rise of e-commerce can certainly be seen as a growth opportunity for postal companies. However, growth will not continue if postal service providers do not actively meet the needs of e-commerce businesses and consumers by making the e-commerce alternative more convenient and providing added value.

Furthermore, distributors specialising in domestic and cross border B2C distribution already exist, and they are continuously expanding into new markets. More will follow. The postal sector has to defend its position and growth potential by customer focused innovation (primarily with regard to IT) and by providing a high quality of service, but also with a focus on costs in the last mile process.

Post Danmark’s delivery standard for B2C parcels is delivery to the recipient’s doorstep (USO). In cities delivery often takes place in the afternoon and can be until 9 p.m.

As an alternative delivery option, Post Danmark has since 2008 introduced 63 parcel machines (named DøgnPosten). These have been very well received by Danish consumers. Post Danmark also offers value added services such as notice of arrival by SMS and e-mail.

Recently Post Danmark launched a partnership with a leading provider of web based solutions to Danish e-commerce companies, in which our IT-based shipment tool, WebPack, is integrated into its web shop solution, making shipments of goods easier.

TELL OUR READERS SOMETHING ABOUT YOUR WIDER RANGE OF LOGISTICS SERVICES.

Our subsidiary, Budstikken Transport A/S, is one of the leading Danish courier & express companies. It has its own nationwide network and collaborates with various global express networks, providing a very competitive service range for express documents and goods.

With the acquisition last year of Transportgruppen A/S, Post Danmark expanded its position in the domestic freight market including the provision of warehousing solutions.

Finally, Post Danmark is one of the leading providers of in house facility services in the fields of office support and company logistics including customised logistics and transport solutions. Together with four other large facility services providers Post Danmark has established Facility Network A/S, a company that develops and sells total facilities management solutions to major enterprises.

Looking ahead to the upcoming merger between Post Danmark and Posten AB, we will be able to offer new logistics services to our customers, both domestic and, even more significantly, to customers that demand shipments to end customers in our main trading partner countries, in the rest of Europe and even globally.

WHAT ARE YOUR STRATEGIES TO IMPROVE THE VIABILITY OF YOUR RETAIL OUTLETS?

The network of post offices is a mixture of post offices operated by Post Danmark, full service outlets, and post offices in shops operated by retailers, typically co-operative stores and grocers. The trend in the last ten years has been to see a fall in the number of independent branches and a rise in the number of post offices in shops. Post Danmark currently has 142 branches that it runs itself, 609 full service post offices in shops, 114 post offices in shops and the 63 Døgnpost parcel depots already referred to.

In recent years there has been a significant drop in sales of letters bearing stamps, as the private share of letter volumes is in decline. There has also been a massive drop in the number of deposits and withdrawals made at post offices, as a consequence of the increased use of the BetalingsService payment system and online banking.

Post Danmark offers no government services at its post offices.

AS WE UNDERSTAND IT, AS PART OF THE MERGER PROCESS WITH POSTEN AB IN SWEDEN, WHICH WE WILL ASK YOU MORE ABOUT LATER, YOU ARE REVERSING A PREVIOUS STRATEGY WHICH INVOLVED A SHAREHOLDING IN THE BELGIAN POST AND HAVING A VENTURE CAPITAL COMPANY AS A SIGNIFICANT SHAREHOLDER IN YOUR OWN ORGANISATION. WHY THE CHANGE?

At the end of January 2009 the Danish State and CVC Capital Partners concluded a conditional agreement on the State acquiring CVC Capital Partners’ holding in Post Danmark. At the same time Post Danmark concluded a conditional agreement to sell its holding in the Belgian postal company De Post – La Poste. This means that the Danish State and the Swedish State can conclude an ownership agreement to bring the merger between Post Danmark and Posten AB one step closer.

It is with some regret that we are selling our shareholding in De Post – La Poste, as it has been exciting to be involved in developing the Belgian postal operator. This does not change the fact that it is the right thing to do. Not only will it pave the way for the merger with Posten AB, but the sale will provide the Danish/Swedish group with an even stronger capital base, which is particularly reassuring at a turbulent time when there is uncertainty in the markets.

TO OUR KNOWLEDGE THE PLANNED MERGER OF YOUR ORGANISATION WITH POSTEN AB IS THE FIRST FULL SCALE MERGER OF TWO NATIONAL-AND VERY SUCCESSFUL-POSTAL SERVICE PROVIDERS IN EUROPE. PLEASE SHARE WITH OUR READERS SOME OF THE DRIVERS BEHIND THE MERGER.

The aim of the merger is to create a strong Nordic postal and logistics company, which is better equipped to cope with a liberalised market, electronic substitution and increasing competition, and across national borders. If business customers, which are the backbone of both companies, are to continue to be offered competitive services, there is a need for an efficient, bigger, industrial postal and logistics company.

It is a merger with a common vision. This is to create one single player, founded on the basis of logical, industrial principles, which can in future fulfil the universal service obligation for all citizens in Sweden and Denmark, with the same high level of quality as is the case today; and to offer the Nordic economy a competitive alternative as regards deliveries to, from and within the Nordic region.

In summary, the main rationale behind the merger can be summarised as to protect the universal service obligation; to strengthen the position in a Nordic market experiencing an increased level of competition; to increase international attraction in the field of primary logistics; to benefit from new business opportunities in a liberalised European market; and to secure wide ranging, value adding synergies in the areas of operations and administration.

The benefits for all customer groups in the Nordic region will be a high level of market presence; availability; long term price efficiency; and the fact that resources will exist to develop modern services.

Benefits for the merged companies’ employees will include increased competitive strength in the long term; better opportunities for development; and ultimately the opportunity for a share in ownership through employees’ shares.

The benefits for the owners are an opportunity to be better able to protect the universal service obligation; to create sustained profitability and opportunities for growth; to ensure continued investments in important infrastructure; and to generate greater potential value.

PLEASE EXPLAIN THE STRUCTURE OF THE NEW BUSINESS. FOR INSTANCE, HOW WILL SHAREHOLDING AND CONTROL BE SHARED?

The new company will be owned by the Danish State and the Swedish State, with the shares divided 40 per cent and 60 per cent respectively. The owners’ influence is, however, balanced, with the effect that the Danish State and the Swedish State have an equal number of votes. The ultimate completion of the merger must be approved by the EU competition authorities.

The parties are in agreement that the merged company will apply for a listing on the Stockholm and Copenhagen stock exchanges within three to five years. In this context it is the intention that employees in both Denmark and Sweden will be able to take part in a share scheme in the merged company.

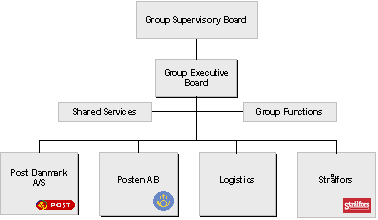

This is the expected organisation chart for the merged company:

POST DANMARK HAS FOR MANY YEARS BEEN NOTED FOR ITS PROGRESSIVE POLICIES WITH REGARD TO EMPLOYEE TRAINING AND DEVELOPMENT. WHAT IS THE CURRENT SITUATION?

There is a focus at Post Danmark on the use of the European Foundation for Quality Management’s (EFQM) Excellence Model and Total Involvement in Quality (TIQ).

The work process is organised in accordance with PDCA (Plan-Do-Check-Act); management by objectives and results; profit related pay from the top to team level; internal and external benchmarking; and a strong focus on quantitative measurements:

- Customer satisfaction

- Quality

- Employee satisfaction.

We place a high priority on collaboration in small, self managing teams. We believe self managing teams create better results in significant areas such as economy, absenteeism and employee satisfaction.

For this reason we are also re-launching TIQ during the spring for all 12,000 employees working in distribution. All employees must look at how we work every single day in order to consider whether there is anything we can do better. TIQ at Post Danmark is about continuous improvements, a focus on facts, involvement and participation by all.

YOU ARE ONE OF THE LONGEST SERVING AND MOST RESPECTED CEOS IN THE INDUSTRY. YOU’VE SEEN MANY CHANGES OVER THE PAST DECADE. DO YOU HAVE ANY THOUGHTS TO SHARE WITH YOUR PEER GROUP?

I will refrain from offering good advice to colleagues on how they should run their businesses. They know that best themselves.

The challenge in the market that all of us in the industry are facing requires an incredibly disciplined effort to make sure that we all survive this financial crisis.

A VERY MODEST NOTE ON WHICH TO CONCLUDE THE INTERVIEW! HELGE ISRAELSEN, MANY THANKS FOR BEING SO INFORMATIVE ABOUT POST DANMARK AND ITS FUTURE.