How strategic choice is helping postal players outperform the competition

Brian Moran and Andre Pharand Changing Times

The postal landscape has shifted since 2006 when Accenture conducted its first study of high performance in the postal industry. Even prior to the current period of global economic volatility, the leading players, jostling for position in response to changing market forces and industry demands, were those organizations that had strategic clarity, a solid focus on cost management and a strong talent equation. Nothing unusual in that you may say: but what about strategic choice? Here the postal operators hesitated. Much as in Henry Ford’s infamous sentiment “you can have any color so long as it’s black”, it was a case of never mind the strategy as long as it is clear and consistent.

Times have changed. Our latest research, Achieving High Performance in the Postal Industry: Accenture Research 2009, indicates that strategic choice and capabilities are far more critical to performance. While traditional cost-cutting measures or operational excellence are still important, high performance in the postal industry is being influenced by factors such as diversification, talent management, innovation, customer centricity, technology and investing in “the network” (physical or retail). Refreshing the earlier research, Accenture discovered that by 2008, twenty three global postal and express players or integrators within four main strategic categories (the global players, the regional diversifiers, the service providers and the traditionalists) were realizing very different results.

Research results

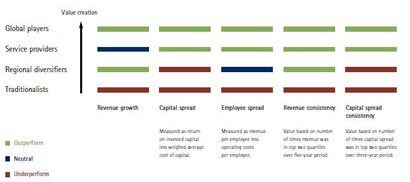

Taking a closer look at the four strategic categories assumed by the postal operators we found that global players deliver the most value to shareholders, service providers have strong revenue and profitability, regional diversifiers have very strong revenues but lag behind in terms of profitability and finally, traditionalists are least successful in sustaining profitable and significant growth (Figure 1).

Let’s take a deeper dive into the research findings:

Figure 1: The strategic categories

The Global Players

Organizations that have adopted a global player strategy have outperformed their peers on all metrics over the last five years. This strategy focuses on service and geographic diversification to drive profitable growth. Mail only services represent a fraction of their revenue.

From a geographic perspective, these organizations have managed to follow and capture the global flows of goods and information. Although they have a market they consider as domestic, they thrive on offering cross border and often higher value services across many geographies.

From a service perspective, most of these players have diversified across transit times and weight categories to encompass mail, ground, express, freight, logistics and supply chain solutions. Lastly, these companies have established retail presence to cater to existing domestic markets and to meet the needs of small businesses and traveling business people seeking infrastructure.

The Regional Diversifiers

These organizations continue to offer mail related and financial services to serve their national customers, but have diversified into upstream mail preparation and into logistics, or both, to meet customer needs, grow business and diversify revenue. An example of diversification is the decision of the Finnish post agency, Itella, to expand into logistics in Russia. Overall, these companies have seen the share of revenue coming from outside their domestic market rising from 8.8% in 2003 to more than 19.7% in 2007, on average.

From a performance perspective, the regional diversifiers have significantly outperformed their peer group in revenue terms as a result of their revenue diversification. But scores are at parity with the peer group when it comes to profitability and consistency of results. Overall, this group is concentrated in Europe, where liberalization milestones are approaching.

The Service Providers

Focusing primarily on the “citizen consumer” relationship, the service providers leverage their networks of retail outlets as the basis for offering services beyond traditional postal services to reach new customers or citizens. An example of this diversification is Australia Post, which offers personal banking services from more than ten different banks and more than fifty credit unions, and Western Union, which offers money transfers and online catalogue services.

To date, postal organizations have diversified very little into government services. Forays in many countries have been limited to processing passport applications. Accenture believes there are further opportunities to diversify revenue through government services. Areas of opportunity include unemployment insurance, driver license renewal or issuing proof of identification cards, to name a few.

Whichever model is used, the results of this strategy indicate above-average growth of revenue, showing that it is possible to grow revenue without expanding geographically. In addition, employee spread is also above average, indicating greater revenue per employee through the service provider strategy (Figure 2).

Figure 2:  .

.

Source: Accenture analysis from company annual reports.

The Traditionalists

These postal organizations have adopted a strategic approach that has primarily focused on improving the efficiency of delivering mail in their domestic markets. These organizations have diversified very little beyond mail, mainly due to a lack of customer focus, a traditional aversion to risk and not having the right talent to drive value when compared with postal organizations who have adopted other strategies. Companies that have adopted this strategy realize nearly all of their revenues from their domestic market and also have a high degree of revenue from mail alone. This is the dominant strategy for ten out of the twenty three postal organizations and integrators Accenture surveyed.

According to our research, this strategy category has been the least successful in sustaining profitable and significant growth, often because there is less corporate focus on the customer and on growth platforms. These organizations have not been able to replace slowly declining volumes on core products such as transactional mail and communications mail. Accenture would not recommend this strategy and only one of the postal operators who performed better than the rest falls within this group.

Achieving High Performance

As our research has shown across multiple industries, achieving a balance between the three building blocks identified by Accenture as essential to become a high-performance business, namely, market focus and position; distinctive capabilities and performance anatomy, is critical. Indeed, while strength in one dimension is good, strength across all dimensions is a better means to achieve high performance.

The approach of “mail just happens” may have worked in the past but is no longer feasible in a world where consumers and businesses have many communication and transportation options. Accenture believes postal operators need to ask themselves searching questions.

Here are a few: Who are my customers and what are their met and unmet needs? How can we increase revenues without increasing the price of a stamp? How much more revenue could we generate through better pricing and bundling capabilities?

Viewed in the context of this latest Accenture research, postal organizations would do well to heed the warning signs and adapt their strategy to one where strong leadership drives change through bold revenue generating initiatives that help their organizations achieve high performance.

Want to know more?

For a copy of the research findings Achieving High Performance in the Postal Industry: Accenture Research 2009 visit accenture.com. Alternatively, contact the report’s authors Brian Moran, managing director of Accenture’s postal industry group, at [email protected] or Andre Pharand, senior manager within the Accenture Supply Chain management service line, at [email protected].