The shape of the recession and its impact on mail

Almost on a daily basis we are hearing conflicting opinions on whether we are coming out of recession. House prices are starting to increase, unemployment is still increasing, consumer confidence is still low and retail sales are bubbling under. So what is happening?

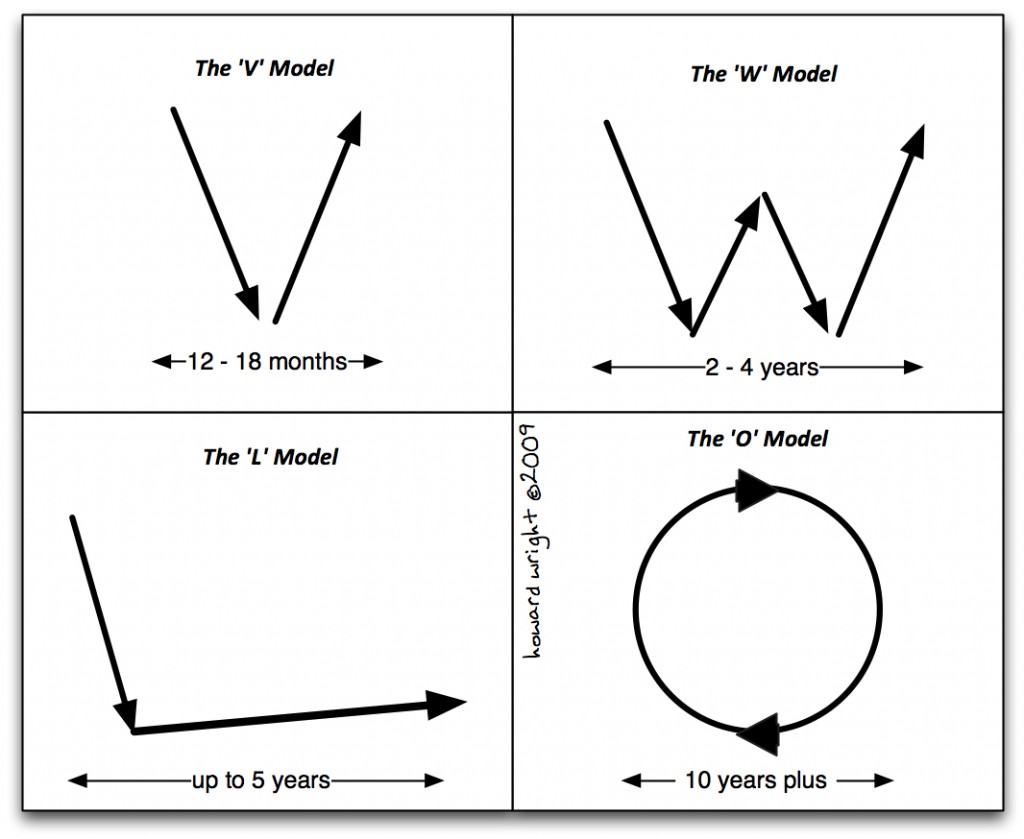

There are a number of models of how recessions can play out and I thought it interesting to explore them and think about the consequences. There appears to be four or five different models of recession we have seen in the past.

- The classis is the ‘V’ recession where we see a sharp drop in the economy followed by a sharp rise. Although this ‘bounce’ can be over many months the result is the same in that the economic indicators etc. come back to a previous high within 12 – 18 months.

- The second model is the ‘W’ where there is a sharp drop in the economy that then recovers and then drops again. This is one, which has caught out business and governments in the past, as the second ‘bounce’ was not predicted. This model has a longer recovery period and can take up to 3 years for the economy to recover to something like its previous high.

- The third model is the ‘O’, which is a continuation of the recessionary effects over a longer period of time. This type of recession can last 10 years or more as seen in Japan. In this model customer confidence doesn’t fully recover, house prices remain at a low, unemployment remains high and governments struggle with stagflation.

- The fourth model, and I believe the one we are going to see in the current crisis, is the ‘L’ model where we see a steep drop in the economy and then a long, slow recovery – probably not seeing significant growth for five years or more. My thoughts are that we are probably not going to get back to 2007 levels until 2013 or 2014 and then only in certain areas.

(I was disappointed that I couldn’t find an E or an S model so I could have spelt Wolves or maybe even VOWEL)

So what does this mean for the postal industry?

One interesting point is that historically postal volumes have been a key indicator of recovery. Marketing mail was a leading indicator of economic recovery as companies started to see green shoots and felt confident enough to start sending marketing pieces out. Mail volumes have always been closely linked to new housing starts – again an indicator of recovery in the housing market. The last significant area is mail generated by the financial services sector that is a lagging indicator of economic growth.

As we see ‘E’ taking over from ‘P’ it will be interesting to see if the mail flips from a leading indicator of recovery or only as a lagging indicator which is relegated to advertising mail responding to economic recovery?

Whichever model plays out it is unlikely that we are going to see the economy fully recover to the over inflated levels we saw in 2007/2008 before the market crashed. House prices will rise, unemployment will start to reduce slowly from mid 2010, and interest rates will remain low for the next nine to 12 months and then start to rise. This rise in interest rates is a good thing; believe it or not, as it can indicate a rise in customer confidence and signs of inflation that are controlled through interest rate rises.

Mail volumes are more difficult to predict as the current threatened strike action is bringing uncertainty for customer and is forcing companies to explore alternative delivery channels and of course a move online.

We will see over the coming months/years whether mail can survive as an effective communication channel and can weather this ‘perfect storm’.