Predicting Willingness to Pay

Daniel Rueda founder and CEO of Open Pricer, a provider of price optimisation software for logistics networks, presents the different methods that carriers can use to predict customers’ willingness to pay for parcel delivery services (both B2B and B2C).

Many executives believe that the price is given by the market and that the only option is to check if the margin at such price is acceptable and sustainable. However, market research and data science show that customers have different willingness to pay (WTP).

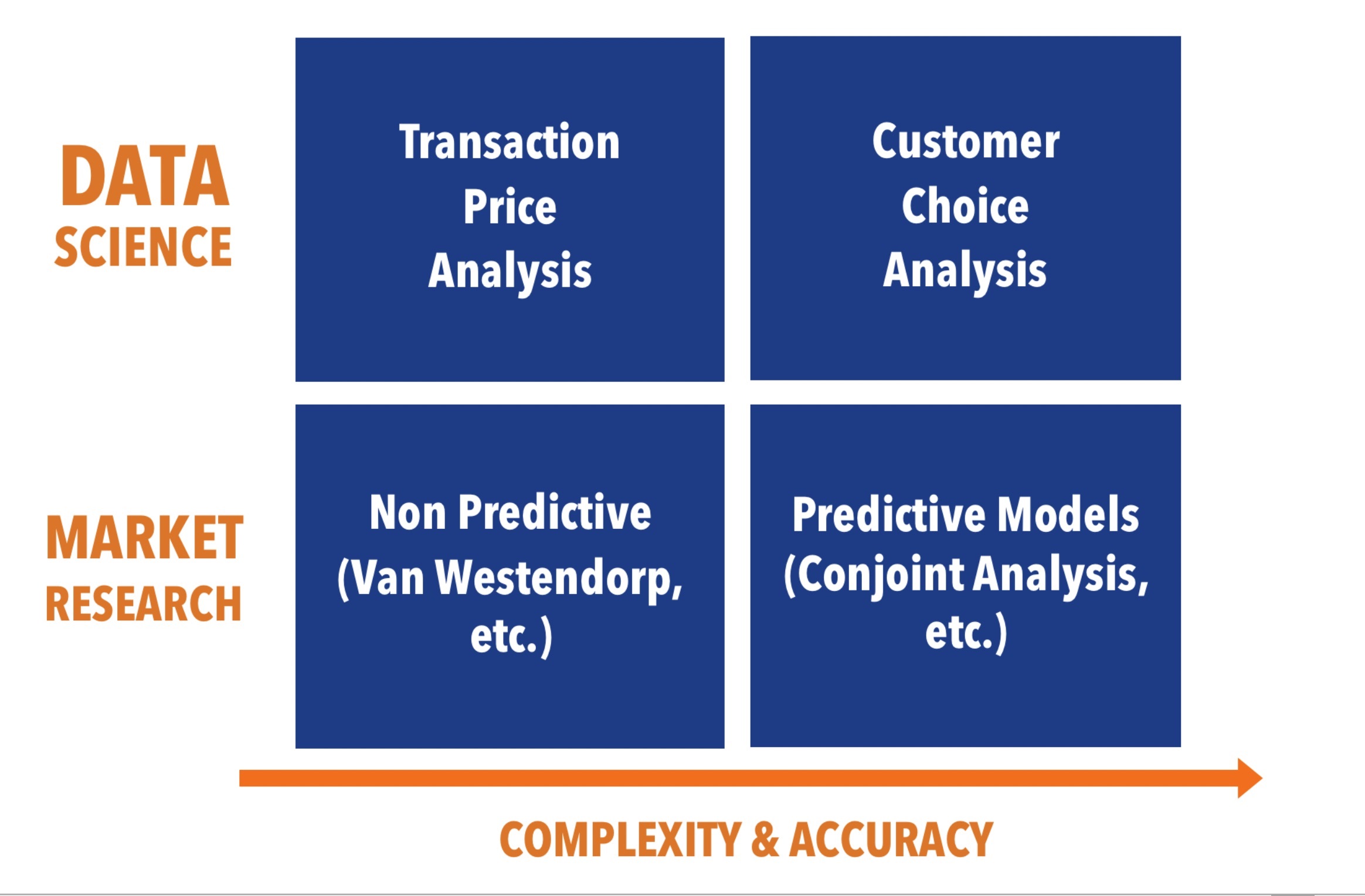

Different methods can be used to predict customers’ willingness to pay (both in B2C and B2B). They can be classified according to their data source (“Market Research” or “Data Science”) and to their complexity and accuracy (“Simple” or “Advanced”).

Classification of WTP prediction methods

Market Research

These methods are based on customer surveys. They use “statement” data: customers state their preferences, i.e. the products and services they would buy at what price in a given context.

Van Westendorp method is a good example of a simple method. The principle is to individually ask four questions about the price of a given product or service to (at least 20) customers or market knowledgeable persons of your organisation (for example sales people):

- What price would seem too high? (“Too expensive”)

- What price would seem so low that it would raise doubts about the quality of the product in your mind? (“Not expensive enough”).

- At what price would the product become expensive enough for you to think before you buy it? (“Expensive”)

- What price would you consider advantageous enough to buy the product without hesitation? (“Cheap”)

This method can be implemented to check whether a product’s price positioning is correct or to estimate an acceptable price range for a new product. However, the Van Westendorp method cannot be used to predict sales or market share as a function of price.

Conjoint Analysis is a more complex and accurate market research method. It requires a minimum of 100 surveyed customers who are asked to answer 20 to 30 choice scenarios. For example, shoppers may be invited to choose their preferred alternative among the following next day home delivery options :

- No time window – free of charge

- 4 h time window for 1 €

- 2 h time window for 2 €

- 1 h time window for 3 €

In each choice scenario, the values of the attributes of each alternative vary. The analysis of responses enables to determine a “utility function” that measures the relative value of each alternative for the customers, their theoretical price sensitivity and the trade-offs that they are willing to make between attributes (price versus convenience). It enables to infer their choice (alternative of maximum utility) in other potential scenarios. Hence, Conjoint Analysis can predict sales and market share as a function of price, taking into account the impact of different product attributes and customer/context characteristics.

Market Research methods rely on stated preferences that may be biased. Moreover, updating the results to reflect changes in the market have a significant cost. Data Science does not have these drawbacks.

Data Science

The first step is to create a pricing data mart that will gather and make available all the data required for analysis, simulation and prediction. Once data is available, two methods can be used to predict customers’ willingness to pay.

Transaction Price Analysis (TPA) consists in analysing what customers are buying at what price and identify how purchasing behavior varies with their characteristics (level of income, industry, country/region, etc.) and based on context (value of goods, period, etc.).

However, TPA does not consider what offers/price levels are not accepted by customers (because lost requests/quotes are not recorded in transaction files). The use of TPA to assess customers’ willingness to pay generally results in an overestimation of WTP at the lowest price points and an underestimation at the highest price points. Therefore, it is important to consider what prices have been proposed to customers and the effective conversion rates observed.

Customer Choice Analysis (CCA) is similar to Conjoint Analysis but based on customers’ actual behavior in the real world (customers’ requests, offers/quotes, win/loss outcomes…). Data science platforms can analyse these millions of interactions and build buying behavior models that can be updated continuously at a very low cost.

Price tests are executed from time to time to enrich the model. These tests are designed to answer the questions: How will this type of customer respond to a higher price? What will be the impact of lower prices on conversion?

Customer Choice Analysis is the most advanced method for predicting WTP and for price optimisation. Unfortunately, until now few carriers have implemented a sales platform (E-Commerce, CPQ or CRM) enabling them to record the data necessary to CCA (i.e. requests, quotes and outcomes).

Combining Data Science and Market Research

Using the best of both worlds is the right approach to progress and achieve pricing excellence:

- The initial set-up of TPA/CCA models can be based on the results of a market survey. Market research can also provide updates for new products/services/features for which there is no historical data available.

- The results of market research can be validated/tuned based on actual transaction/choice data, thus saving costly updates of market surveys.

- The impact of some variables that cannot be captured from sales/operations data can be evaluated by market research and then set in the TPA/CCA model.

- Finally, data science can identify customer micro-segments that have a unique behavior (eg. low conversion or high attrition) and require to develop a specific market survey to understand the root cause.

Market research and data science are two complementary approaches that enrich one another. With their combination carriers can obtain reliable predictions of customers’ willingness to pay and find the right prices to increase conversion and capture more value.

The case of Chronopost

Chronopost, a subsidiary of DPDgroup, is the express delivery leader in France. It has implemented Transaction Price Analysis (TPA) as an add-on to the OP Smart Quote CPQ. This enables sales executives to calculate in real time the most suitable tariff for each customer or prospect taking into account all relevant factors. OP Smart Quote enables sales teams to better manage commercial negotiations. They are more responsive and autonomous. “Our sales executives have made significant changes in the way they work. They have gained commercial efficiency and approach negotiations with much more confidence”, explains Franck Philippe, Chronopost Chief Sales Officer. See full video testimonial here

For more information visit www.openpricer.com

About Open Pricer: Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. This solution is based on our extensive experience gained from working for many years with global market leaders. It will help your teams to improve pricing strategy, build more accurate quotes, optimise price increase campaigns, effectively monitor contracts to retain customers and maximise their lifetime value.