Dynamic Pricing: It’s Time to Change

In the first of three articles on parcel logistics pricing, Daniel Rueda, founder and CEO of Open Pricer explains what Dynamic Pricing (DP) is and why it will become standard in the industry.

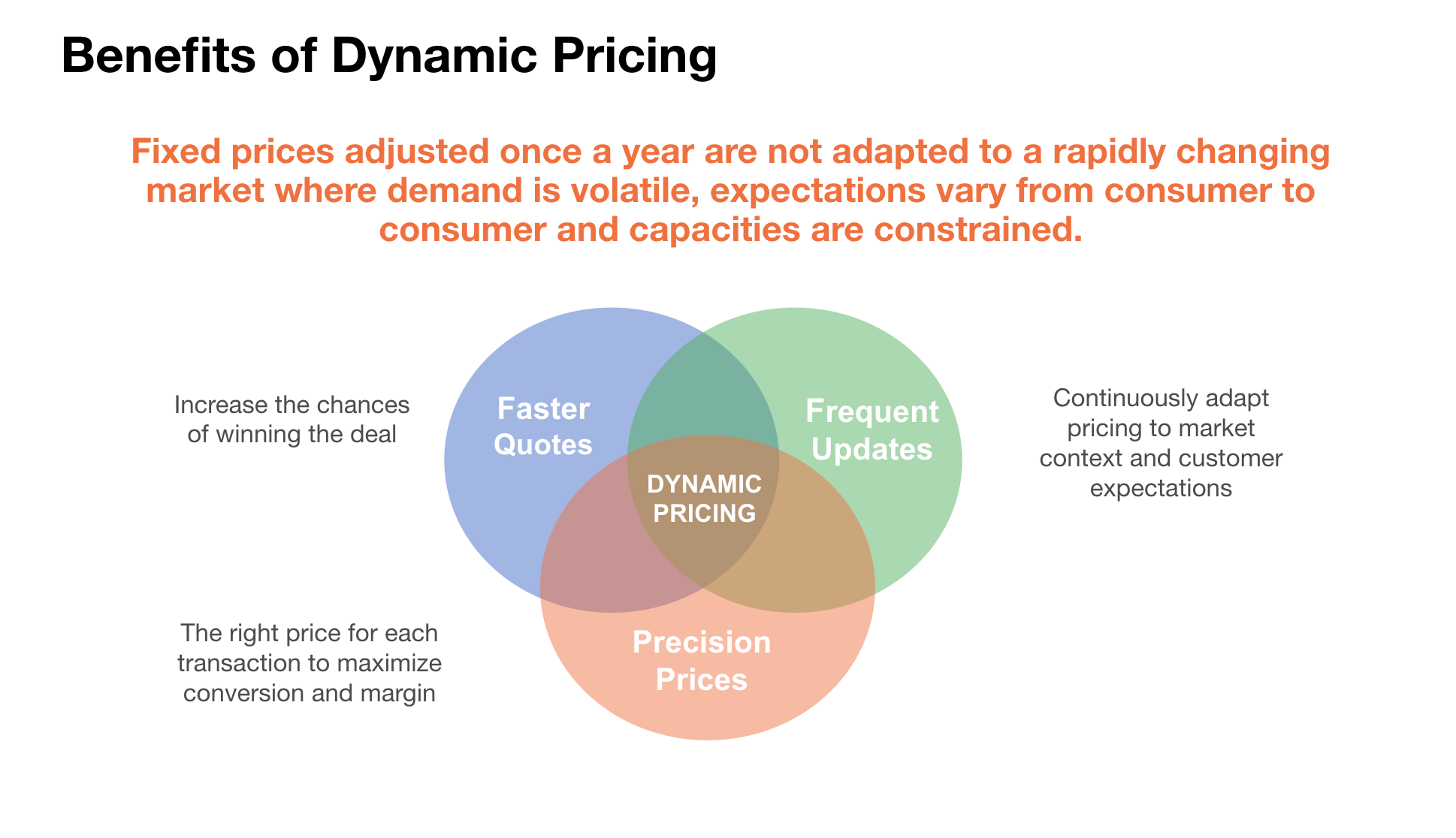

Dynamic Pricing embraces three concepts: speed, precision and frequency.

Faster quotes. Customers now expect instant response to their service requests. Being the first carrier to quote increases the chances of winning the deal, because some customers are not price sensitive and just want to quickly find a solution. However building an offer currently takes hours, days or even weeks because pricing logic is in spreadsheets and involves human experts and non-automated workflows to collect internal approvals and manage exceptions. To survive in the digital age, carriers must reduce time to quote down to hours or even minutes instead of days or weeks for contracts and deliver spot quotes in real time. To do so carriers must invest in CPQ – Configure, Price and Quote – systems which are able to manage all sales channels, including web (self-serve). Enabling customers to access pricing information online (e-signature, rate cards in digital format, activity reports or building their own quotes with simulations through carriers’ portal or from their own TMS) will improve customer experience and provide a competitive advantage.

Precision. The pricing of parcels is complex and depends on multiple factors that drive costs and perceived value. Therefore, the right rate card is different for each deal. In the absence of an accurate price segmentation, carriers run two risks: (i) low conversion due to a high price, and (ii) money left on the table due to a price below customer’s willingness to pay. To date, most carriers use volume (or revenue) based discounts or a cost-plus-margin approach for strategic accounts. DP introduces a new methodology based on data science and machine learning. First, the prediction of customers willingness to pay from transaction prices, win/loss analysis and market prices. Second, the forecast of capacity utilisation to identify network “peaks” and “valleys” by shipping date, origin and destination then enabling to set price premiums for peaks and incentives for valleys.

Frequency is the last and most common concept involved in DP. The market has become extremely dynamic. Static prices valid for a whole year are not adapted to this changing environment. On the other hand, contracts are not systematically monitored and deviance with initial targets not corrected. DP is first about moving from yearly rate cards to quarterly, monthly, or even weekly rate cards to reflect market changes and seize network opportunities. Second DP is about a systematic monitoring of customer contracts in order to adjust prices in case of underachievement of targets set at quote time (such as number of parcels per month, average weight, product mix, delivery density, etc.) or to define incentives in case of identified risk of attrition due to price.

Dynamic Pricing is at the cross-roads of supply chain challenges.

Digitalization. Carriers and shippers must increase efficiency while reducing costs. As explained above, carriers that turn their pricing process digital will increase sales performance. Those lagging behind run the risk of losing performance and market share.

Sustainability. The transport sector is responsible for around 30% of GHG emissions and a larger share of harmful pollutants in cities. On top of that, traffic is expected to grow steadily over the next few years at a CAGR of between 5-10%. Carriers commit to reducing these emissions and invest in fleets of hybrid and electrical vehicles. An additional and less costly lever is to optimize the use of capacity: having fewer trucks on the roads and delivery vans in cities for the same volume of shipments. DP can play a key role in increasing capacity utilization by smoothing demand in peak periods and filling capacity in valleys. For example, increasing the average load factor from 70% (current level) to 85% (achievable target) would reduce emissions by 17.6%.

Market Disruption. The Covid health crisis has disrupted the supply chain: boom in e-commerce, segments growing at 2-3 digits while others plunge, change in product mix and logistic KPIs (average weight, delivery density, etc.). Therefore, as the market changes very quickly, carriers have to adjust prices at the same pace.

Demand Volatility. Which sectors, segments, products and regions will increase or decrease, and when, remain uncertain. In such a context, it is essential to monitor demand in real time and develop predictive models. Fixed prices adjusted once a year are not suitable for a rapidly changing market where demand is volatile, expectations vary from consumer to consumer and capacity is under pressure.

Capacity Constraints. The supply of scheduled airlines has been limited by the crisis driving up the prices of international products. In the US domestic market, major carriers’ networks are saturated: accepted volumes are limited and regional carriers are gaining market share. In Europe, major carriers report general capacity constraints in peak season as well as many network points saturated on specific weekdays in off-peak season.

Profitable Growth. Carriers must invest in additional capacity to meet demand, and they need to do it in a profitable way.

These different challenges cannot be met with a pricing policy based on fixed rates, valid for a year or more. Therefore, carriers need to switch to DP. Let’s see why the time is right.

The right time to rebalance pricing power.

Traditionally, the balance of pricing power has been in favor of the shippers and retailers. One of the reasons is that they have more information than the carriers. They can easily compare carriers’ prices, and performance to source the best solution with their TMS or using new digital platforms that provide price and quality benchmarks.

On their side, carriers continue to offer long-term agreements at fixed rates with limited commitment from the shippers. They exclusively rely on internal data to set prices and this data is most of the time not complete, consistent, nor easily accessible. Therefore, one of the key challenges is to improve the quality of decision support data (i.e. to implement a Pricing Data Mart) including external market data from parcel intermediation platforms used by shippers and retailers.

The good news is that pricing power is shifting in favor of carriers. More than ever, shippers and retailers need their logistics partners to meet the challenge of growing demand and to improve the service expected by more demanding consumers. Carriers now have a window of opportunity to rebalance pricing power. It is the right time to change the rules of the pricing game so that the industry can pursue a more profitable growth.

In the next article I will discuss the first steps a carrier can take to implement Dynamic Pricing.

Learn more about Dynamic Pricing

About the author

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.