USPS reveals retail alternative, with up to 3,653 post offices to close

The US Postal Service revealed a new concept today it believes will prove “very important” as it seeks to streamline its retail network in the face of declining use of the mail – the “village post office”. The unveiling came as USPS disclosed at a press conference at its headquarters in Washington DC a list of nearly 3,700 post offices across the US that it now intends to review for possible closure – more than one in 10 of its post offices.

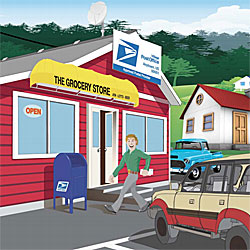

In place of many of the facilities that are closed, the village post office concept will see partners running a range of postal services on the behalf of USPS. This is most likely to be small, local businesses such as grocery stores or gas stations, but could also be operated out of libraries, town halls or other public buildings.

Postmaster General Patrick Donahoe said today that the village post office concept was about bringing services closer to where Americans live, work and shop.

But, he also stressed the need for the Postal Service to shutter standalone post offices if they are clearly underused.

“Our retail network was not built for today’s customers’ demands,” he said this morning.

“What we know is that revenue will continue to go down. We have to look at our transport network, our delivery network and our retail network – these are where the money is going. More and more people will use the internet – but we have to be where customers go.”

Donahoe briefed the staffs of the US Senate and House of Representatives last week on the post office closure reviews, and the Postmaster General told Post&Parcel that there had been an understanding on the Hill about the reasons why alternative access was needed.

“I’m sure there will be questions about this,” he said, “but they are understanding the situation that we are now in. Provided the right conversations take place, there shouldn’t be a problem.”

Donahoe added that he believed those in Congress support the village post office concept if the universal service obligation is to be supported going forward.

“It’s not just about reducing our retail costs,” he said. “Village post offices mean opportunities for small businesses in rural areas – a small grocery store might be struggling to survive at the moment, but running a post office would get a real opportunity.”

Village post offices

USPS believes village post offices provide the answer for retail efficiency in rural areas

The USPS already has retail sector partners providing stamp sales, known as Approved Postal Providers, and along with its own 32,000 post offices, this adds up to around 100,000 postal retail outlets across the country.

By comparison, even Starbucks has only 11,500 outlets in the US, while package shippers UPS have 4,300 franchise outlets.

Village post offices would offer a broader range of services than just postage sales, including letter and parcel pick-up, plus post office boxes – but would still offer a more limited selection of services than a full post office.

They would also offer opening hours beyond those of an ordinary post office, USPS executives said.

Kelly Sigmon, USPS vice president of channel access, told Post&Parcel that the village post office concept is not a franchise model, such as those run by rivals UPS and FedEx across the United States. The Postal Service will pay their partners to run village post offices, though there could be a variety of forms of contractual agreement, she explained.

Along with village post offices, Sigmon added that USPS will continue to look at other ways customers can access postal services.

In rural areas, mail carriers are also being offered as providing some of the services of a post office – letter and parcel pick-up, but also sale of stamps. Alternative sales points are also being rolled out including electronic terminals, while USPS internet-based services are being enhanced.

“We are continuing to look at kiosks,” she said, “we have 2,500 kiosks in our network, many located at post offices, providing 24-hour, seven-day-per-week service. We’ve also just launched a new face for the USPS.com website, and the second phase of the launch in October will see a number of new applications.”

“Our number one goal is to enhance the customer experience,” she added.

Post office closures

The list of 3,653 post offices set for possible closure was selected based on their footflow, workhours and revenue generation, but the four-month-long review process will also take into account alternative access available in the local area, executives said today.

New rules have been finalised that amend the post office closure process – allowing executives to select post offices for closure review for the first time, and allowing post offices to be closed for reasons including low traffic, workhours and available alternative access points.

Those currently on the list for possible closure were identified among post offices making as little as $27,500 in revenue a year or less, operating as little as two hours a day. The list also includes post offices generating less than $600,000 in annual revenue if they have at lease five alternative access points within two miles.

And, post offices generating $1m in annual revenue do not escape closure review either, if they have five or more alternative access points within a half mile.

“None of those post offices listed for review are preordained for closure,” said Dean Granholm, VP of delivery and post office operations. “But revenue and customer visits are declining rapidly in these locations.”

Some those post offices already being considered for closure even before today’s list of 3,700 emerged could be the first to be converted to village post offices.

Around 50 are expected to be unveiled this fall – the very first contract looks likely to be signed within three weeks. Ultimately, as many as 2,500 village post offices are expected to be on the USPS network in the coming months.

Donahoe said he believed the streamlining of the retail network would save $200m a year for USPS, which has been making annual losses above $8bn the last two years. But, he said it would be only part of the solution to the Postal Service’s financial problems.

“We’re making $65bn a year this year, next year it will be $64bn a year the way things are going,” he said. “We have to be operating in 2015 with costs $20bn less than we are today.”