Out-of-home delivery: before, during and after COVID-19

Mike Richmond, Doddle CCO has collaborated with Parcel Monitor – a platform for e-commerce logistics insights – to give an overview on the impact that the pandemic has had on out-of-home delivery strategy and usage.

The article also predicts what will happen going forward as consumers spend less time at home as the management of the pandemic changes and allows for more freedom.

“As with so many things, our specialist area (out-of-home delivery and returns) is now best understood in terms of before COVID and after COVID. Not necessarily after COVID in the sense of the disease disappearing, but after its initial emergence and the array of responses made in nations around the world. At different rates, something like normality is being resumed around the world, which makes this a strategically important time for parcel carriers and postal operators. They have decisions to make about how to invest in their delivery networks, about how they should think about the evolution of their overall delivery offer to merchants.

The UK has been one of the worst affected countries in the pandemic, but has also had a successful vaccination programme with around 75% of the adult population being ‘double-vaccinated’ at the time of writing this article. The vaccination programme is proving effective at reducing the number of people seriously ill and, consequently, the UK is ‘opening up’ sooner than many countries. This makes the UK a useful case study in what consumer behaviour might look like in the near future.

In this article, we’ve worked with the team at Parcel Monitor to examine delivery success rates and the rate of OOH deliveries. We have combined that data with the results of an extensive YouGov survey commissioned by Doddle on the post-COVID future of delivery to paint a picture of what COVID has meant and will mean for the world of out-of-home delivery.

Before March 2020

Throughout 2018 and 2019, we were working with postal services and carrier businesses who were keen to consolidate more of their last mile volume and deliver more customer choice through an improved out-of-home delivery offering. During that time frame, we also saw rising consumer adoption of OOH, and some big moves made in the market. Amazon, created the leading PUDO network in the UK in the space of around 18 months, and the UK Post Office ended its exclusive relationship with Royal Mail, setting the stage for other carriers to use 11,500 post offices as pick-up and drop-off points.

Internationally, we launched new relationships to develop PUDO networks for Yamato, Starlinks & Australia Post, and we launched a new partnership with USPS on returns. E-commerce growth showed no signs of slowing and consumer awareness of out-of-home delivery options was rising. In short, it seemed clear to us that while home delivery would always remain the way most parcels were delivered in most markets, we were extremely confident out-of-home would continue to gain market share.

The first year of the pandemic

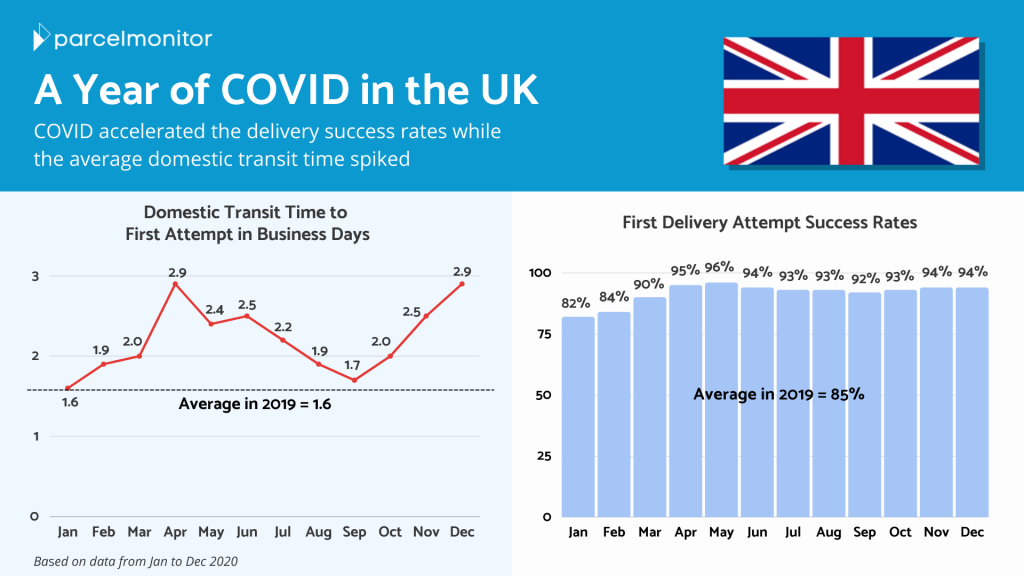

The spring of 2020 and the era of lockdowns had a huge impact on the home: out-of-home delivery ratio. Consumers around the world were instructed or advised to remain at home unless absolutely necessary. Non-essential retail shut down, e-commerce spiked. Posts and parcel carriers suddenly had a new and unexpected boom to manage, new safe working protocols to implement, and home delivery was now more reliable than ever before thanks to consumers being reliably at home more than ever before and a relaxation on any ‘signed for’ and / or ‘leave safe’ protocols. A YouGov survey commissioned by Doddle found that almost two thirds (65%) of UK adults spent much more time at home after March 2020, and another 15% said they spent slightly more time there. Concurrently, data from Parcel Monitor shows that UK first-time delivery success rate rose from 84% in February 2020 to 95% by April 2020, against an average of 85% across all of 2019. (February and April are the best comparison points as a national lockdown was introduced midway through the month of March.)

The impact of COVID pushed down OOH usage significantly. In the UK, Parcel Monitor’s data showed it was down to just 4.6% of parcels delivered for the whole of 2020. This happened for a few reasons. Firstly, with many more shoppers spending much more time at home, there was a massively reduced consumer demand for flexibility in deliveries. Home delivery is much more convenient when you know you will be at home. Secondly, a lot of those retail locations which would be used by consumers to pick up parcels were closed. Think of Amazon’s partnership with Next, for example – over 500 premium PUDO locations were closed in an instant.

As out-of-home delivery volumes dropped, home delivery performance suffered. Parcel Monitor’s data show that deliveries took an average of 2.9 business days in transit before the first delivery attempt in April 2020, up over 50% from 1.9 in February and well above the 2019 average of 1.6 days. However, as parcel carriers added more capacity and established effective ways of working in line with social distancing protocols, that transit time declined steadily over the year to September, where it was nearly realigned with the 2019 average at 1.7 days. The knock-on effect on customer experience was noticeable too. Metapack survey data suggests that shoppers were 5 times more likely to have a poor delivery experience in 2020 than in 2019.

As the UK went back into lockdown in the early months of 2021, the percentage of deliveries to collection points decreased even further relative to FY 2020, down to 4.3%. This appears to be the floor for OOH delivery in the UK, after a long period of COVID-conscious behaviour by shoppers and several versions of lockdown implemented by the government.

The next phase

The UK marked a turning point in COVID policy in mid-July, eliminating many restrictions and encouraging more people to return to their workplaces. While a total return to pre-COVID norms isn’t expected, our YouGov survey in August 2020 showed that 58% of UK adults were already spending the same amount or less time at home than they did before COVID. That’s a significant proportion of shoppers who are back out in the world most days, not able to guarantee availability for a home delivery.

The predominance of home delivery and its first-time success rate is therefore likely to return to something like pre-COVID levels, and the consumer need for flexibility is already returning. Data from the same survey showed that 79% of UK adults believed flexibility was fairly or very important when they were choosing delivery options, which meant flexibility was the top concern after cost and speed.

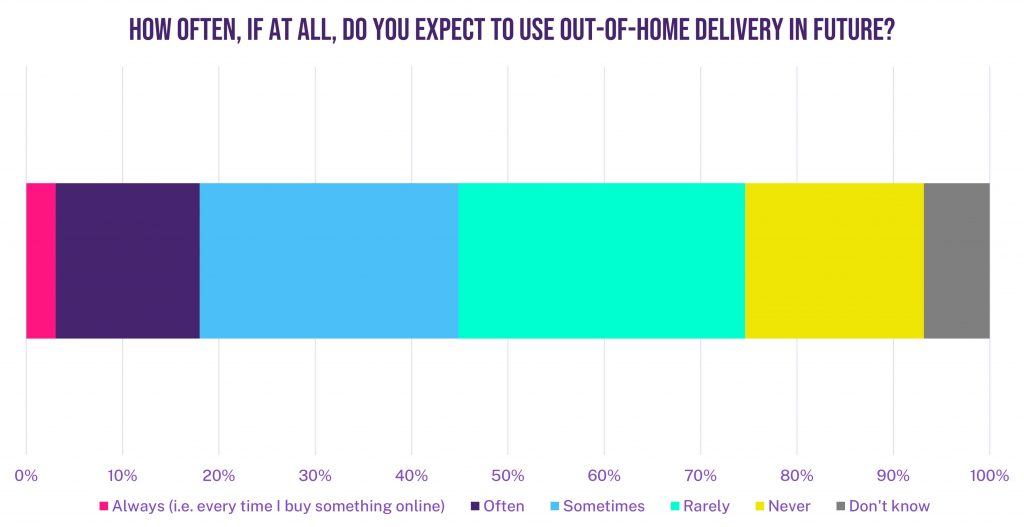

That is reflected in their expectations about future delivery choices. 45% say they expect to use OOH delivery options always, often or sometimes, versus only 40% saying they did so pre-pandemic. Perhaps the biggest shift is that prior to COVID, 29% of shoppers never used out-of-home delivery options – in future, just 19% expect to never use them. As shoppers spend less time at home and their routines vary more, flexibility is driving willingness to adopt new delivery methods. 52% of respondents named flexibility and the ability to avoid missed home deliveries as a benefit of OOH deliveries.

One of the key lessons in our survey is that consumers are surprisingly willing to change their habits once the benefits of out-of-home delivery become clear. We asked those surveyed to read the following statement:

“Rather than delivering parcels/ online shopping directly to customers’ homes, studies have shown that the use of consolidated out-of-home delivery options, which can include Post Offices, news agents and local supermarkets, can be used to reduce the number of journeys delivery drivers need to make, resulting in fewer emissions and less congested roads. Increased use of out-of-home delivery options can also mean fewer missed deliveries for customers.”

Based on that statement, we then asked if they’d be willing to switch their delivery preferences to use out-of-home options more than they currently do. 49% said they would, and another 13% were undecided. Even in the absence of pricing incentives, it’s fascinating that nearly half of consumers are willing to change their habits according to new information about the benefits of an out-of-home delivery.

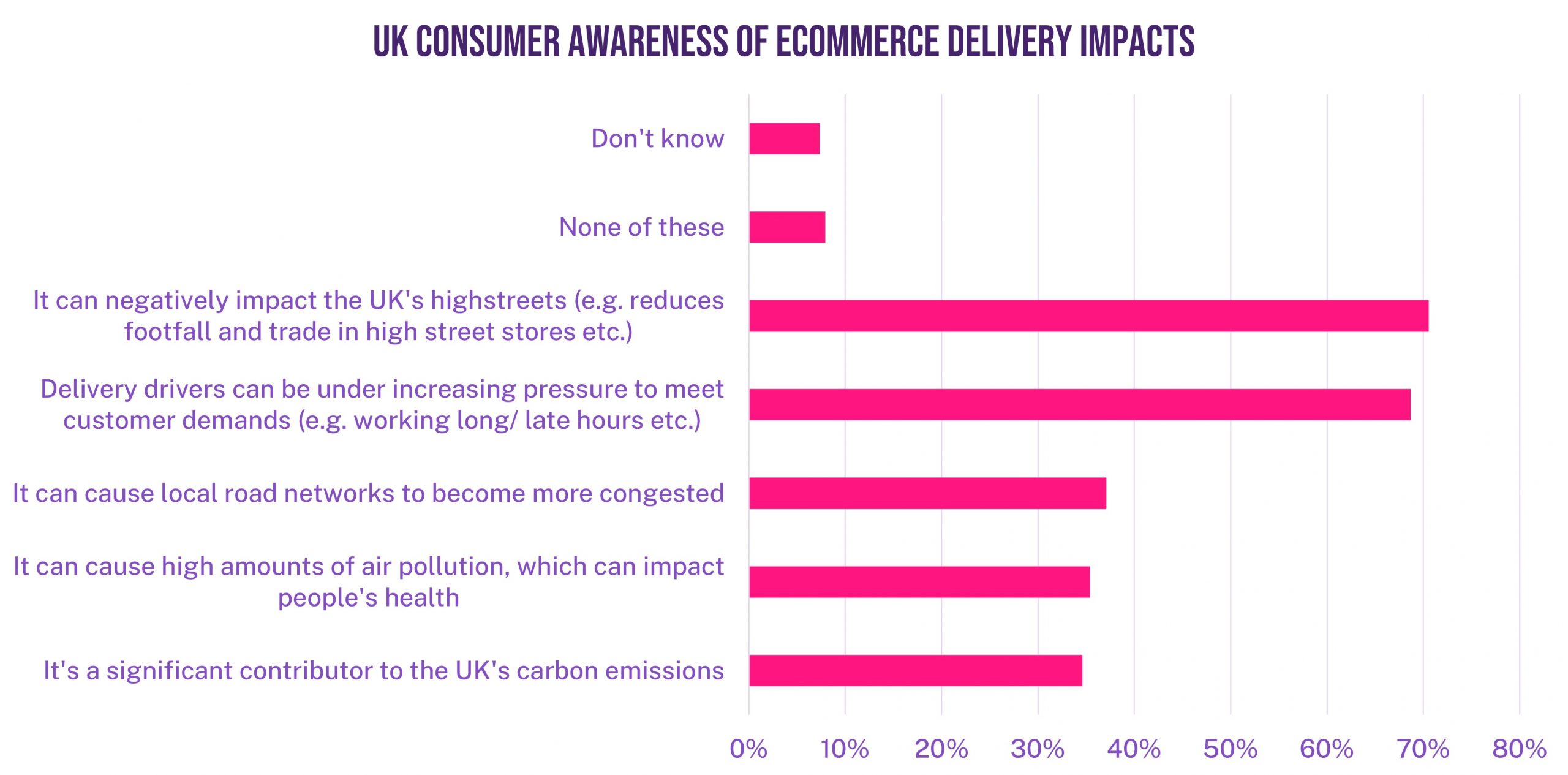

This reflects a theme that runs through all of the delivery research we have run, which is that consumers are generally not highly aware of the impacts of their delivery choices, but once they understand those impacts, they do care about them. While UK shoppers are familiar with e-commerce deliveries having impacts on the drivers that deliver them and the High Street shops who lose out to online shopping, they’re less likely to be aware of the impact of home deliveries on congestion, air pollution and carbon emissions.

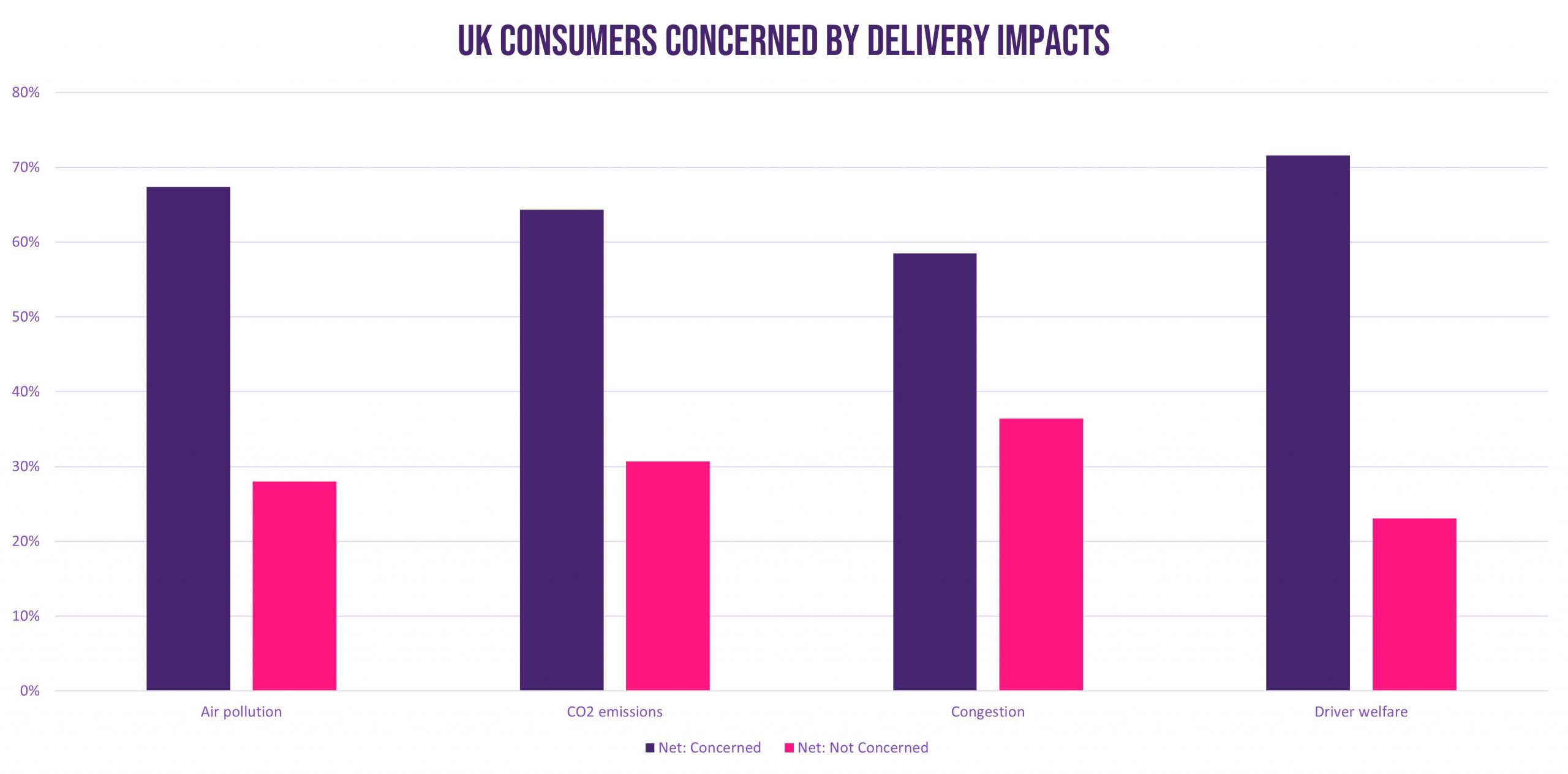

When prompted though, they are generally concerned by these impacts, which may explain why having the benefits of out-of-home delivery made clearer makes them more willing than not to shift their behaviour. We can see the same pattern in recent research from Sendcloud on sustainability, where 62% of shoppers said they would be willing to use alternatives to home delivery if retailers provided emissions data at the checkout showing the benefit.

Push and pull factors

For carriers, the incentives have not changed. Growing home delivery capacity to face the pandemic has been a difficult and costly task, and with e-commerce set to continue growing even as countries re-open it will not become any cheaper or easier to add capacity. Consolidation reduces the cost of each delivery and allows more deliveries on shorter routes. Our research highlights ways for carriers to push consumers to adopt more out-of-home, consolidated options – primarily by highlighting its various benefits in terms of sustainability and flexibility. At the same time, consumers who are quickly returning to spending less time at home increasingly value flexibility and avoiding missed deliveries, which will increase their demand for out-of-home options, pulling carriers to invest in their out-of-home networks.

The UK is currently the test case for much of the world in terms of restrictions and re-opening. Carriers need to watch closely to understand how that shift is altering consumer behaviour and incentives – similar patterns will occur in other markets as shoppers spend less time at home, but spend even more on e-commerce.”

About Mike Richmond

Doddle technology powers out-of-home delivery and returns for posts and carriers around the world, improving their cost-effectiveness and customer experience.

Doddle technology powers out-of-home delivery and returns for posts and carriers around the world, improving their cost-effectiveness and customer experience.

Mike is responsible for Doddle’s engagement with postal organisations and parcel carriers, working with them to improve their out-of-home delivery propositions and helping them to increase consumer preference for out-of-home delivery methods. You can find more from Mike on the Doddle website , on LinkedIn, or via email at [email protected].

Parcel Monitor

By leveraging on their data capabilities, Parcel Monitor creates an open space for the ecosystem to discover, collaborate and innovate.