Delivery’s psychological CX impact and what to do about it

Mike Richmond, Doddle CRO, discusses the role emotions play in a customer’s perception of a positive delivery experience.

“Recently, we hosted a brunch with Ogilvy Group’s vice chairman Rory Sutherland and a dozen logistics leaders. Over some nice food, we discussed all sorts of topics, including the right metrics to measure in delivery, the challenges of changing consumer behaviour, and the future of carriers as impactful, digitally-enabled partners for merchants in ecommerce.

One recurrent theme was the impact that delivery has on the overall ecommerce experience and how crucial it is to brand perception and future purchase decisions. Rory, who had recently talked at this at length on the Diary of a CEO podcast, explained it to us in terms of the “peak-end rule”.

The peak-end rule and last-mile delivery

Nobel Laureate and psychologist Daniel Kahneman came up with the “peak-end rule” to describe how we remember our experiences. The theory states that our memories are most strongly shaped by how an experience ends, and the most extreme parts of the experience. So, for instance: a viewer watching Titanic would be unlikely to weigh each moment in the three-hour runtime evenly. Their experience and how they feel about it would be primarily determined by the ending and the ‘peaks’: the ship sinking and Jack’s death.

In ecommerce, delivery is both the peak and the end of a purchase experience. It’s the moment a shopper gets the item in their hands, and, unless they decide to return something, it’s the final part of the purchase experience, and so delivery has an outsized influence on how shoppers feel about any given purchase. That makes it one of the most important aspects to get right.

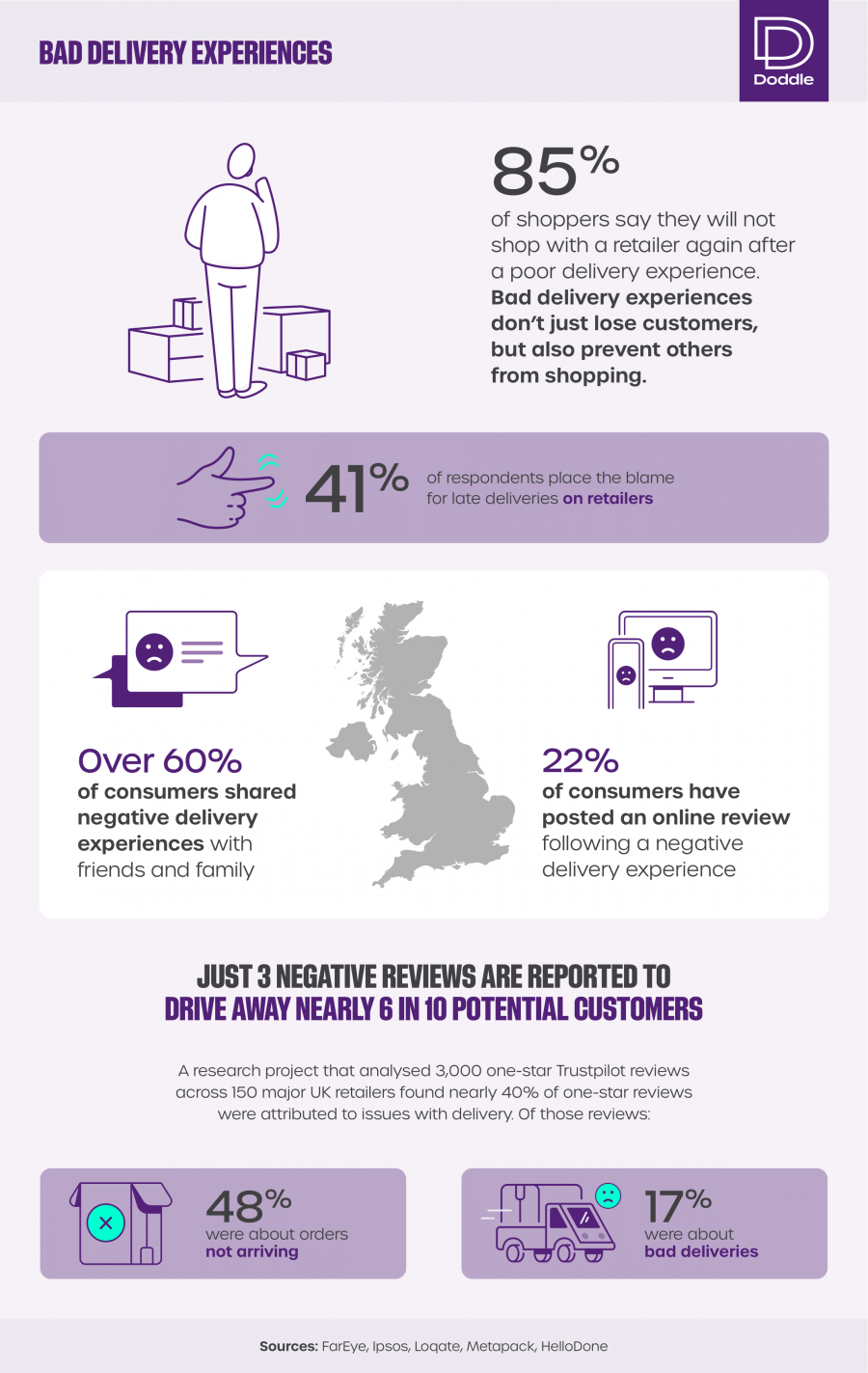

After a bad delivery experience, 85% of consumers stop shopping with a retailer. Even worse, they can also drive away future customers if they post bad reviews, as this infographic shows:

Of course, consumers want parcels to arrive safely and on time, with a minimum of stress and effort on their part. They can even be put off buying if they believe that delivery experience might be negative. The Global Parcel Theft report shows that a third of UK residents have reported concerns about sending or receiving parcels due to loss or theft – with 4 million UK shoppers saying this concern is enough to make them reluctant to shop online.

How a psychological understanding could change how we measure delivery success

Retailers monitor almost every possible touchpoint consumers have up until the point of purchase, spending huge amounts of time and resource on improving everything from site traffic numbers to optimising the UX to improve conversion by small percentage points.

By contrast, once a parcel is out of the door and away from the digital world of easily monitored and controllable touchpoints, most retailers stop paying as much attention – beyond their operational concerns of examining SLAs on how many deliveries are late and how many are unsuccessful.

But there’s more at play here than those two ‘SLA-metrics’ can measure. A parcel could be delivered on time, but the customer experience can still suffer from how it was delivered. A parcel might be left in an unsafe place, or get wet in the rain, or the delivery driver could be rude, or the item might have been damaged in transit.

These experiences are emotional, evoking anger, annoyance, frustration or upset. Those emotions then come to dominate the memory of the overall experience, because they’re a ‘peak’, to use Daniel Kahneman’s terminology. They are also hard experiences to reliably measure, which makes it hard for retailers to understand how to prevent them.

To make a difference in the experience side of delivery, retailers need support from carrier partners who are better placed to collect experience data and can share advice on how to improve it.

Efficiency vs customer experience

Carriers will always face a difficult balance between hyper-efficient models and providing a great customer experience and, most of the time, becoming hyper-efficient means that the customer experience suffers.

Drivers are tasked with increasingly heavy workloads and short turnaround times, resulting in generally poor brand interactions as they are forced to ‘drop and run’. It’s about getting as many deliveries out in a short space of time as possible, not greeting everyone with a smile.

Although some aspects of consumer experience are tracked, such as failed delivery rate, much of this data is analysed from an operational, rather than a CX viewpoint.

Capturing direct customer feedback via surveys or follow-up emails where shoppers rate their delivery experience is probably the best means carriers have to generate a better picture of the CX impacts of delivery. The challenge for them is to capture as much of this data as possible, and to figure out how to make it useful for a merchant customer.

OOH delivery can help strike a balance

Poor delivery experiences regularly result from anxiety (when will this arrive at my door?), stress (what if I’m not there?), unexpected outcomes (a broken item, a missed delivery date), and the creation of additional work for the consumer (come to a delivery office to collect). With a psychological lens, these outcomes fall into 2 distinct categories: a lack of control and concerns over security.

Out Of Home delivery, or PUDO, is a delivery option that directly addresses those two categories of concern offering a more secure and flexible experience for shoppers. And the net result is clear in the data. From our work with posts and carriers, we know that OOH delivery typically has higher NPS scores than home delivery. For example, Australia Post retailer OZ Hair & Beauty saw that adding OOH delivery options boosted overall Net Promoter Score by 8% and first-time delivery rates by 20% between July 2020 and June 2021. Other carriers like InPost, Post Nord, bpost and DPD have also talked previously about how their customers give PUDO deliveries higher CSAT ratings than home delivery.

Carriers have this data but so few seem to use it to drive a behaviour change that will simultaneously help their own business. By pairing the quantitative NPS elements of their delivery data with qualitative survey responses to build a compelling picture to retailers that highlights the power of OOH delivery to ensure consumers get a stress-free delivery experience. Retailers prioritising and promoting OOH delivery see better outcomes in terms of NPS, average order value and conversion rate, in large part because of the psychological security that it offers shoppers.”