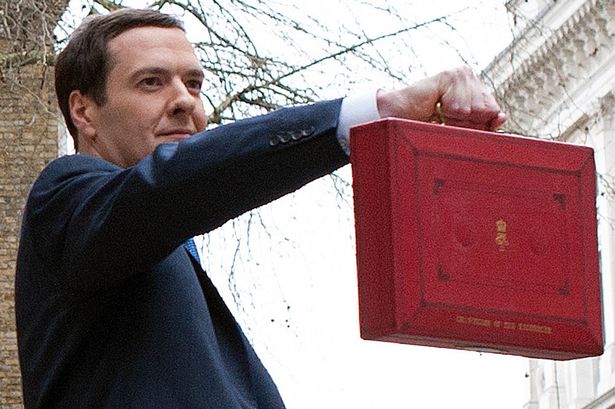

Industry reaction to UK Budget

UK Chancellor George Osborne’s Budget drew a mainly positive response from the delivery sector, especially with regard to fuel duties. Andrew Hill, commercial director at Electio, told Post&Parcel: “I’m encouraged by the Chancellor’s announcements to cut taxes for the oil and gas industry including effectively abolishing petroleum revenue tax.

“Osborne claims that freezing fuel duty for the 6th year in a row means that the average driver will save £75 a year. For commercial road users, this has a high value and is a huge relief as it goes against many of the predictions before the announcement.

“Halving crossing tolls on the Severn Bridge by 2017 is also excellent news for the logistics industry – and a big boost for carriers using this major gateway to Wales every day!”

The international parcel broker ParcelHero also welcomed the freezing of fuel duty.

ParcelHero’s Head of Consumer Research, David Jinks, commented: “With the basic price of fuel being at an historic low, raising fuel duty might have seemed like quite a painless option for the Chancellor; but any increase would have been reflected in increased fuel surcharges by delivery companies, making the cost of delivering items more expensive and hitting SME traders hardest. It’s welcomes news this anticipated rise will not happen.’

ParcelHero also applauded the news that more than £230m has been earmarked for road improvements in the north of England, including upgrades to M62 and upgrades of A66-A69.

“Congestion in the North of England increases delivery times and unnecessary emissions,” said Jinks. “The new infrastructure improvements will help UK couriers speed up deliveries while further reducing the industries carbon footprint.’

Jinks – like Hill -was pleased with the halving of the toll for the Severn crossing, and he also noted that there was some good news for the SMEs and online marketplace traders who use ParcelHero’s parcel broker service. The annual threshold for small business tax relief is to be raised from £6,000 to a maximum of £15,000, exempting 600,000 firms; and the headline rate of corporation tax – currently 20% – is to fall to 17% by 2020.