Opportunity or Threat: Brexit divides opinion among international carriers

Saeed Mumtaz, Director of Research & Consultancy at Triangle Management Services, explores the divergent attitudes of international carriers towards Brexit ahead of the release of the 2017 UK International Mail and Parcels Digest.

The UK public voted to leave the European Union (EU) back in June 2016, and we now have little more than a year to go before the scheduled exit date of 29 March 2019. But many of us in the mail and parcel sectors are no clearer as to the direction of travel despite one of the most seismic events in Britain’s economic history.

Unsurprisingly, our conversations with service providers reflect this acute sense of uncertainty but what’s interesting is the difference in their outlooks for the future.

As part of our Annual UK International Mail and Parcels Digest, we speak with over 50 service providers including postal operators, the UK’s leading consolidators, parcels carriers, fulfilment and mailing houses. Brexit is high on the agenda with our respondents and despite all agreeing that it represents a significant challenge for the delivery industry, the attitudes towards the future are markedly different.

Last year’s survey took place just after the vote to leave and as you’d expect, most were in a state of utter disbelief. Now that the dust has settled there is a clear divide in opinion among parcel operators about what Brexit will mean for their business.

On the mail side, most would agree that it is very much “business as usual”. Given that distribution of mail and printed materials is not subject to the same tax and duty legislations as parcels, the only negative view on Brexit was the potential for a loss of revenue as UK customers may look to cut back marketing activities to the EU. An example could be the relocation of financial centres to EU with the potential loss of revenue for mailers involved in this sector.

For carriers, the picture is a lot less clear. On the whole, there’s a great deal of scepticism about the government being able to deliver Brexit effectively. When we asked them about what sort of contingency plans they were making in light of Brexit, the responses were still very much in line with views in 2016: “We just don’t know what’s going to happen”, however many are already thinking of contingencies including alternative markets or strategies to mitigate risks.

For many years, the UK has enjoyed tariff free access to the EU market. Parcels and packages have moved seamlessly over borders and the UK has become an international hub for Europe, redistributing packages for mailers and shippers from the USA, Asia and Eastern Europe. The UK has benefitted hugely from its hub status and, as you would expect, many or our carriers chose to focus their efforts on the EU, shying away from notoriously difficult exports to BRICS nations and the like.

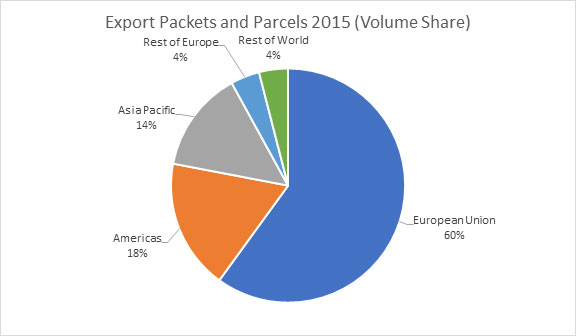

Results from our 2016 survey found two thirds of the carriers we interviewed classified themselves as specialists in Europe. What’s more, the share of export of packets and parcels by volume was 60% for the European Union as shown in the diagram below.

Export Packets and Parcels 2015 (Volume Share)

But with the UK’s status as a European Hub and volumes now very much under threat due to Brexit, carriers who have traditionally focussed on the EU are now faced with the prospect of moving strategic hubs to within the EU. While these carriers will continue to earn revenue from their European businesses, jobs in the UK will invariably be lost as a result.

And as for the UK shippers themselves, the sensible among them will probably look to source more product domestically and, if they are big enough, manage their supply chains from distribution centres within the EU itself. So not only will the UK lose its key role in distribution, it’s likely that European industry is likely to focus its supply chains away from the UK.

At this stage, we’re painting a fairly bleak picture in our post Brexit world but it wasn’t all doom and gloom from our carriers.

A few viewed the trials of Brexit as a unique opportunity. While many of their competitors were focussing on the good life of tariff free access to the EU, these carriers bucked the trend and focussed their businesses on building expertise in “rest of World” export. Developing the skills and knowledge to navigate difficult tax and cross border controls in BRICS and other international markets, these carriers are far more optimistic about their chances in post Brexit Britain. With expertise in difficult markets and a rough road ahead for the EU, these carriers see themselves as uniquely placed to take advantage of declining EU parcel volumes and (hopefully) increasing international ones.

Contingency planning is one thing but none of us at this stage is clear on the direction of travel for Brexit. Opinions are still divided on the future outcome for the UK market for international carrier services, and there are still many more questions than answers.

Will a focus on BRICS export pay off given lower than expected growth in these markets in 2015? How will UK based international carriers cope with what looks set to be falling volumes to the EU? What would be the alternative strategies and growth markets to target? Will the UK HMRC have the capacity to manage the VAT implications of a so called Hard Brexit are to name but a few.

As we draw closer to the publication of the 2017 UK International Mail and Parcels Digest, our aim is to answer these questions and more. Now in its third year, the Digest will help you to identify potential scenarios and offer opportunities to mitigate the worst effects of Brexit and other future challenges.

The Digest is due for release in February 2018 and we would welcome your opinions and thoughts on the challenges facing international carriers operating in the UK market.

If you would like to register your interest in the Digest, or to explore the topics in more detail, please get in touch with Saeed Mumtaz, Director of Research and Consultancy on +44 (0)1628 642910 or email [email protected].