Dynamic Pricing for E-Commerce Delivery

In the last of three articles on parcel logistics pricing, Daniel Rueda, founder and CEO of Open Pricer, explains how to use DP to improve consumers’ delivery experience and implement an economically viable model for e-commerce delivery.

This article is written with the contribution of Milkman Technologies, provider of customer-centric supply chain management technology focused on last-mile home delivery. This innovative technology enables dynamic pricing, driving revenue opportunities for businesses and customer satisfaction.

You can find the first (introductory) article here

1. Carriers perspective: economic viability and sustainability

Parcel carriers differentiate their services according to speed of delivery (e.g. next day, same day, instant) and type of delivery (e.g. home, business, pick-up point, locker). For each service, a rate card is defined per parcel weight and destination zone (region for domestic and country for international).

The cost of delivery represents up to 50% of the total cost of a shipment. However it is only taken into account in average terms when defining these rate cards whereas it significantly varies depending on delivery density (i.e. parcels delivered per hour = parcels per stop x stops per hour). For example, If the average delivery density is 12 p/h and the cost per hour is 20 €, then the average delivery cost per parcel is 1.67 €/p. However this average cost covers very different situations as illustrated in figure 1.

Figure 1: Cost significantly varies depending on delivery density

Consequently some carriers include delivery density zones in the rate card negotiated with retailers. For example: city centers with difficult/restricted access, high density suburbs (with apartment buildings), medium density suburbs (with separate houses), remote areas (countryside). This price segmentation approach limits their risk when retailers work with multiple carriers and cherry-pick the best offers from each of them.

Cost of delivery is also a function of capacity utilization that varies by season, day of week and time of delivery. In periods of high demand (peak season and mid-week) carriers must add delivery capacity at higher cost. In periods of low demand delivery circuits are not fully utilized resulting in a higher delivery cost per parcel. In the case of peaks the price should be increased to compensate for the higher costs and in the case of valleys the price should be decreased to stimulate traffic, increase capacity utilization and decrease the cost per parcel. This mechanism could be implemented based on a preset rate calendar (as shown in article 2) or based on actual bookings. Milkman Technologies’ Home Delivery Platform dynamically adjusts delivery prices algorithmically considering requirements such as capacity and density patterns. Milkman Smart Appointment is the platform feature that matches fleet capacity and predicted density, giving retailers and logistic professionals a strategic advantage to successfully manage fulfillment and customer journey.

Leveraging DP to increase capacity utilization by smoothing peaks and filling valleys will enable carriers to maintain a high level of service and support retailers in the rapid growth of their traffic. It will also contribute to the sustainability of their operations by reducing polluting particles and GHG emissions: fewer vehicles on the road for the same level of parcels delivered.

2. Consumer perspective: reliability and flexibility

As e-commerce grows rapidly, shoppers expect reliable information on timing of delivery. Many want to choose the place and time windows of delivery and are willing to pay for convenience options that make their lives easier.

Delivery options are similar to service upgrades proposed by airlines, railways and hotels. When booking a flight you may choose between different alternatives: automatic seat allocation – by default and included in the price of the ticket – or selection of a seat with extra space, located in the first rows, an aisle or a window, etc. The price of selecting a given seat is displayed in the cabin plan. It is based on the selection rate recorded at different price points. Convenience options enable airlines to increase revenue by more than 10% and improve customers’ satisfaction and loyalty thanks to a personalized travel experience.

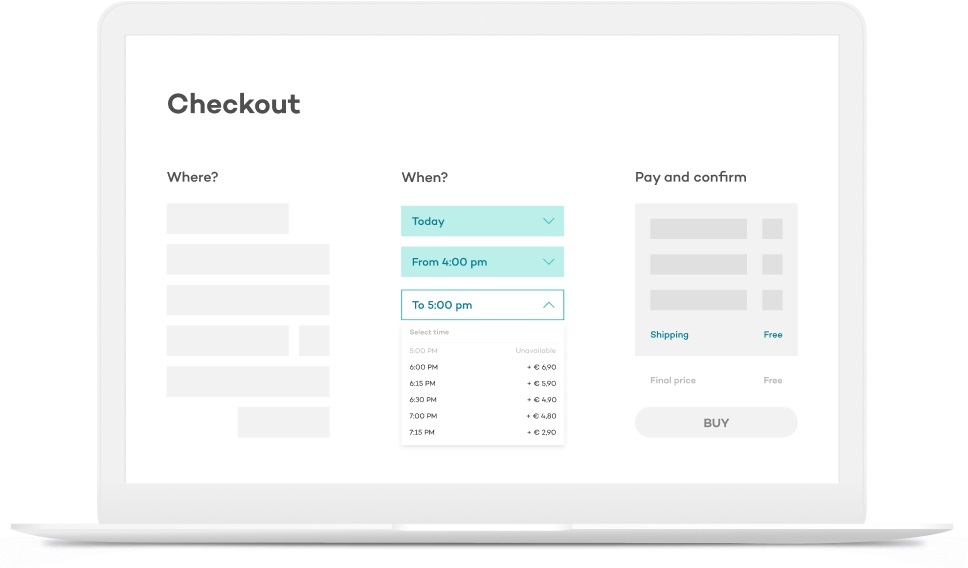

In the case of e-commerce, the choice of the delivery time window provides the ultimate flexibility to customers (see figure 2). Milkman Tracking Page (API) is the module that enables shoppers to select the delivery time window according to the shipping fee. This is based on hyper-automated algorithms for real-time demand shaping.

Figure 2: Selection of delivery time window

The price of delivery options can be calculated (1) based on the predicted cost of delivery – that varies depending on distance to delivery point, delivery density/capacity utilization – and (2) taking into account the predicted willingness to pay of the consumer that may depend on purchase history, home postal code, basket amount, etc. As with airline seat selection, (3) analyzing past customer choices also enables us to predict the right price for each option.

Open Pricer has developed a methodology that combines all these ingredients (costs of delivery, consumers’ willingness to pay and analysis of consumers’ actual choices) to define an optimal price point for each option.

3. Retailer perspective: competitive advantage

DP is nothing new to major retailers. They have been applying DP to optimize their margins for many years in the form of mark-ups for constrained inventories, markdowns for perishable inventories, promotions to generate traffic, differentiated pricing according to shoppers’ price segmentation. These retailers leverage big data to calculate click-through rates (CTR) for each SKU at different price points, thereby estimating willingness to pay and finding the right price at the right time for each product and for each consumer to maximize conversion and margin.

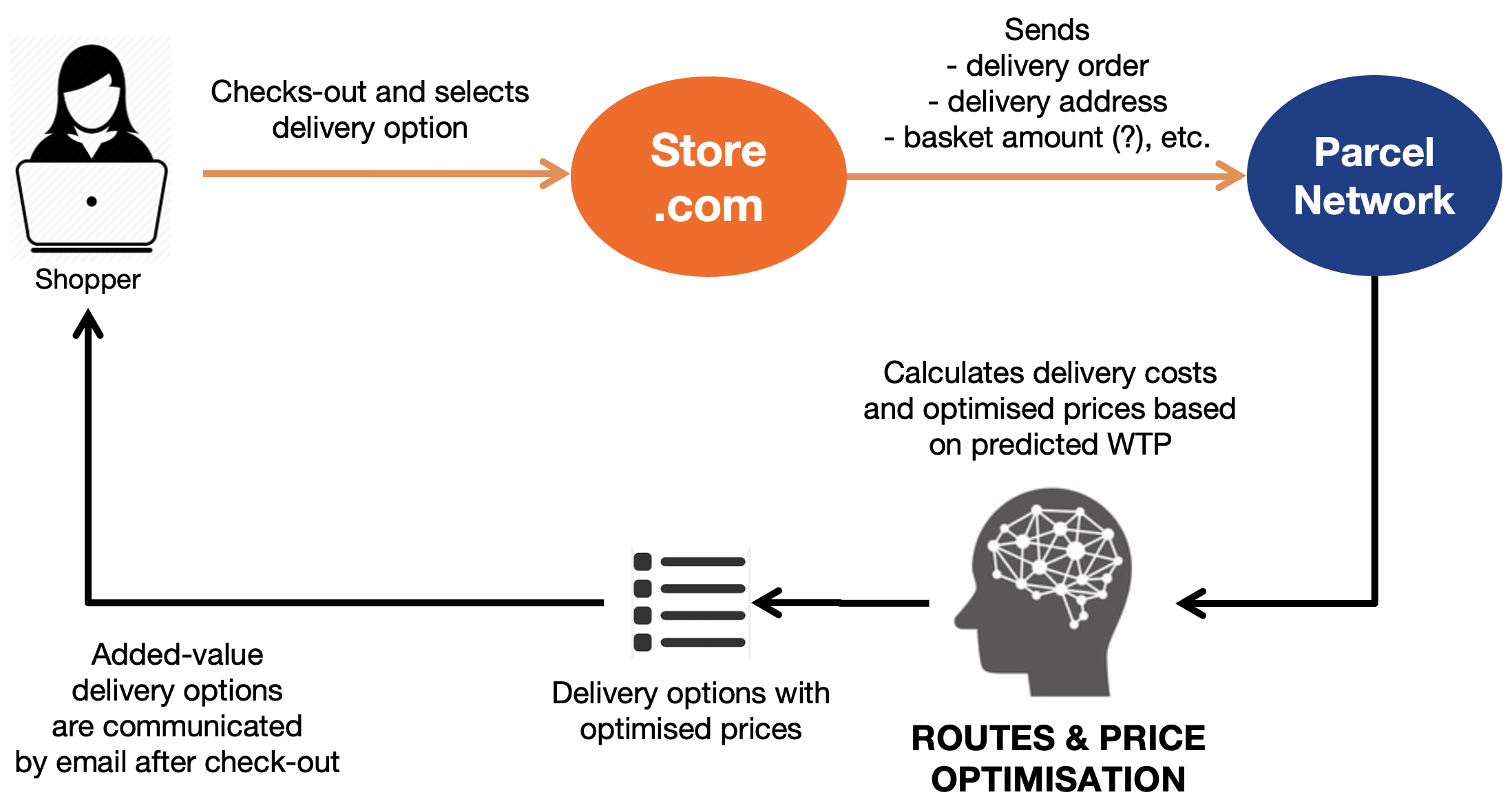

Shoppers’ delivery experience (reliability and flexibility) is key to retailers’ value proposition. This is why DP is a win-win solution for carriers and retailers to develop a viable and sustainable model for e-commerce. To do so, carriers and retailers shall build a trustful collaboration based on exchange of information. Two possible models for delivery options can be envisioned. First, carriers can sell the delivery options post-checkout (figure 3.a). This model has a limited involvement of retailers and may be a good starting point for leading parcel networks.

Figure 3.a: Carrier sells delivery options post-checkout

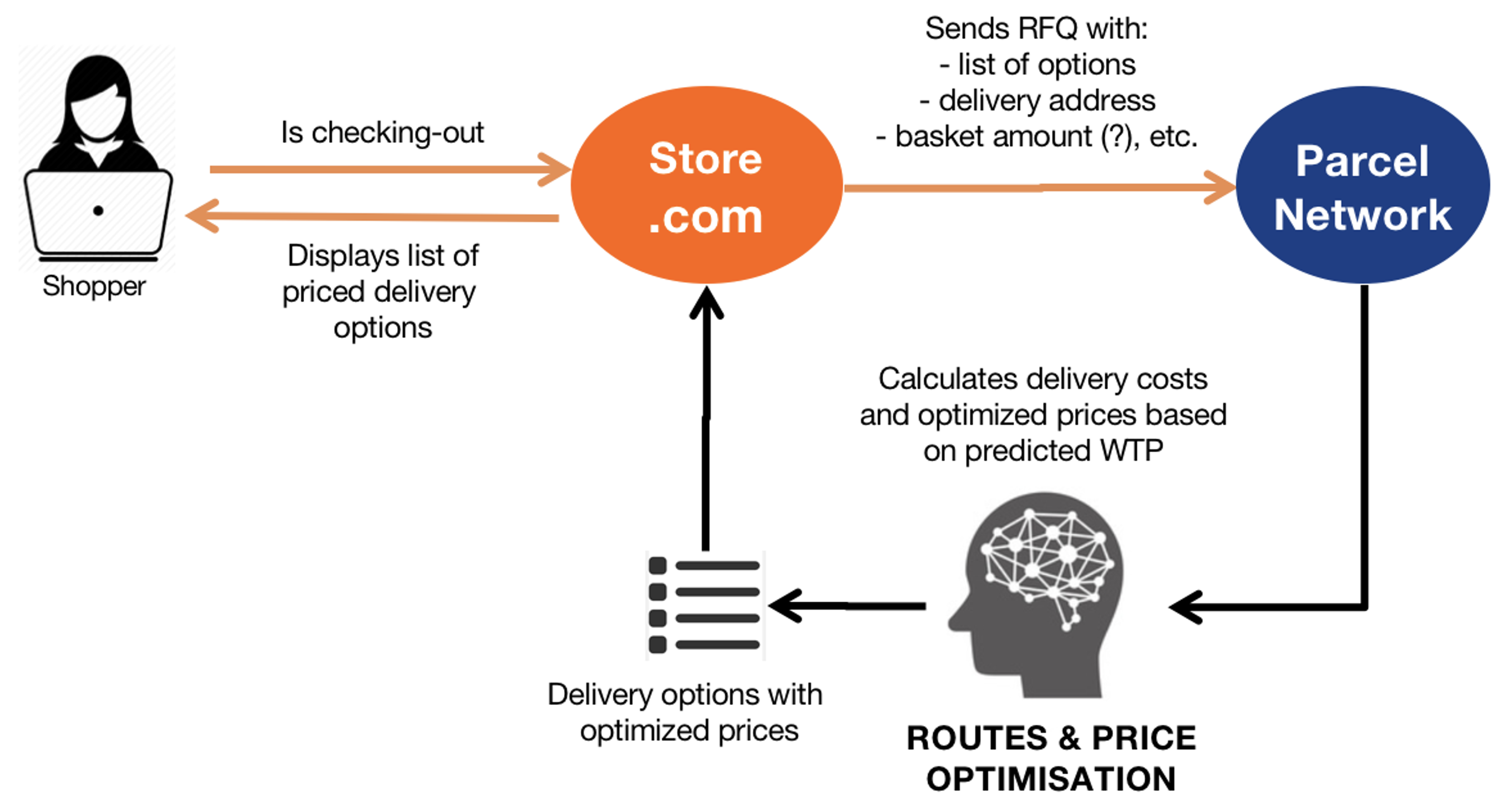

The second model corresponds to a tight collaboration between retailers and carriers and integration of their systems: delivery options are quoted in real-time at checkout by the retailer. E-commerce fulfillment platforms such as Milkman Technologies can play a key role in the development of this model.

Figure 3.b: Tight collaboration/integration – real-time quote at checkout

These models imply a trustful collaboration between retailers and parcel networks. They could provide the level of service expected by shoppers with economically viable solutions. Carriers and retailers that will first adopt DP for e-commerce delivery will gain a major competitive advantage over peers who still apply fixed prices.

Contact our pricing experts to learn how to implement Dynamic Pricing: https://www.openpricer.com/contact-us/

Learn more about Milkman Technologies: https://www.milkmantechnologies.com/

About the author

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.