First steps to implement Dynamic Pricing

In the second of three articles on parcel logistics pricing, Daniel Rueda, founder and CEO of Open Pricer presents the two foundations required to implement Dynamic Pricing. You can find the first part here.

In the last article I described the three benefits provided by Dynamic Pricing (speed, precision, frequency), explained why DP is at the cross-roads of supply chain challenges and why it is the right time for carriers to leverage DP to rebalance pricing power with shippers in order to achieve profitable growth. This article will present the first steps of the journey to implement DP and the benefits provided by each of them.

Dynamic Pricing is based on the digitalization of pricing processes in order to gain quotation speed and update the pricing policy more frequently. This goal requires to put in place a system able to automate pricing processes that are currently manual and not integrated.

On the other hand, improving precision requires switching to data-driven pricing (based on Data Science and Machine Learning) to assist your sales and pricing experts instead of relying on a rules-based system that will be quickly obsolete in rapidly changing environments.

Data and Automation Platform are the two foundations of Dynamic Pricing.

Let’s start with the data foundation.

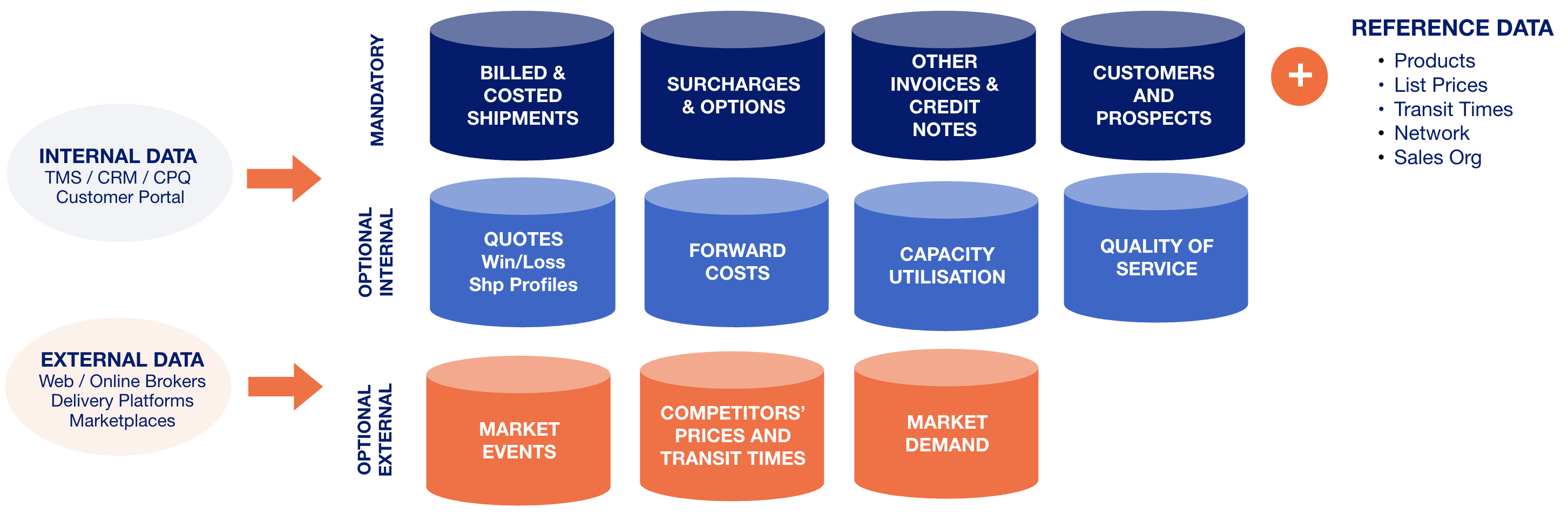

Step 1: Implement a Pricing Data Mart. A Pricing Data Mart is basically a condensed and more focused version of a data warehouse that contains all the data to support pricing processes. Pricing decision support data is often scattered in separate silos. When pricing and sales teams need to use it, it is not easily accessible or is poorly organised. What’s more, it often exclusively consists of internal data (transactions, customers data, products…). However, external data on market offers, prices and demand is also useful but rarely available. So the first requirement is to have real-time access to internal and external data thanks to a Pricing Data Mart fed on a regular basis (real time, daily, weekly or monthly depending on the data).

Figure 1 Data Feeds to Pricing Data Mart

Step 2: Implement an integrated Pricing Platform. The other foundation of DP is to produce and distribute pricing recommendations in real time. The challenge is to manage an increasing number of complex decisions in an increasingly limited time. Let’s take the example of a parcel network with 10,000 clients that on average use 3 products with 49 rate cells (ex: 7 zones and 7 weight bands). This network must manage almost 1.5 M (million) rating decisions per year for current customers. If this network makes 5,000 quotes per year for new business or extensions, that adds 0.7 M decisions, giving a total of 2.2 M rating decisions per year. Now imagine the network wants to move to a monthly revision of rates depending on customers’ trade performance or changes of costs or market conditions. This now leads to a total of 18+ M rating decisions per year. Each of these decisions is based on multiple factors that determine costs and customers’ willingness to pay. Of course, optimizing all of these decisions cannot rely on manual processes supported by XLS spreadsheets. This is simply impossible without an integrated pricing platform.

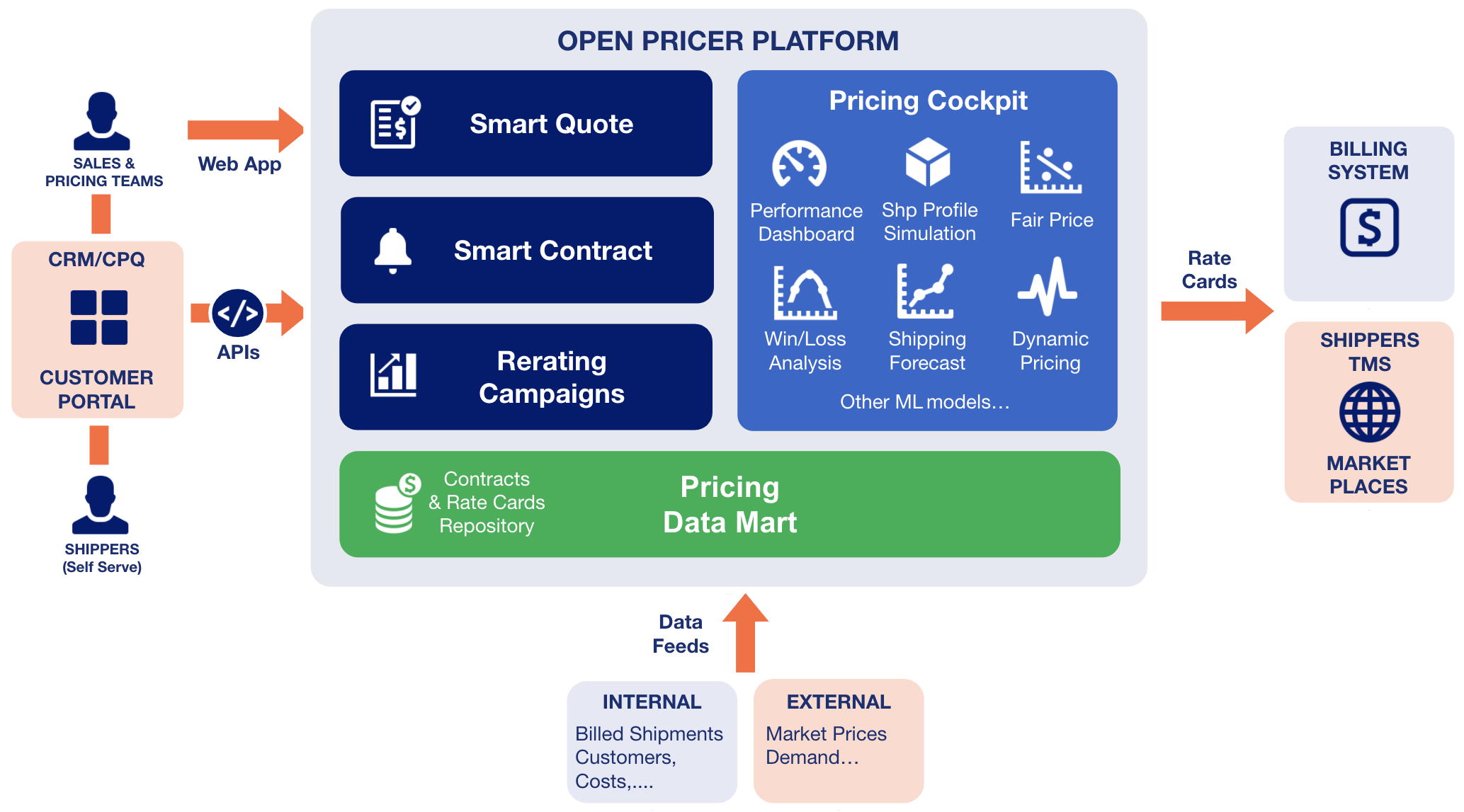

Figure 2 presents at a high level how an integrated pricing platform works.

Sales and pricing teams access the Pricing Platform either directly using a web app or through the CRM/CPQ. In this case, these applications communicate with the pricing platform through APIs and pricing recommendations and insights are delivered in the background. The API architecture also enables shippers to access their rate cards or their activity reports through the customer portal. The platform produces recommendations and alerts on the basis of data gathered on an on-going basis that feeds the Pricing DataMart (see figure 1). The platform produces three types of recommendations:

- Smart quotes for all types of deals (new business contracts, extensions of existing contracts and spot shipments);

- Contract monitoring alerts based on the analysis of shippers’ trade analysis that enable your sales team to systematically identify opportunities and risks and take the right actions at the right time;

- Re-rating recommendations to optimise your general rate increase campaigns and to adjust prices in case of deviance between actual trade and initial forecast.

The recommendations and alerts are generated by the Pricing Cockpit that measures performance and is composed of a set of Machine Learning algorithms. Once validated thanks to a configurable workflow, the rate cards are automatically sent to the billing system, shippers’ TMS and Marketplaces.

Let’s take an example of a dynamic pricing process that can be implemented thanks to the platform. Parcel networks are saturated during the peak season but also on other days in off-peak season. For this reason, it is increasingly important to measure capacity utilisation rate by date and depot for the delivery process which accounts for up to 50% of the costs for many carriers.

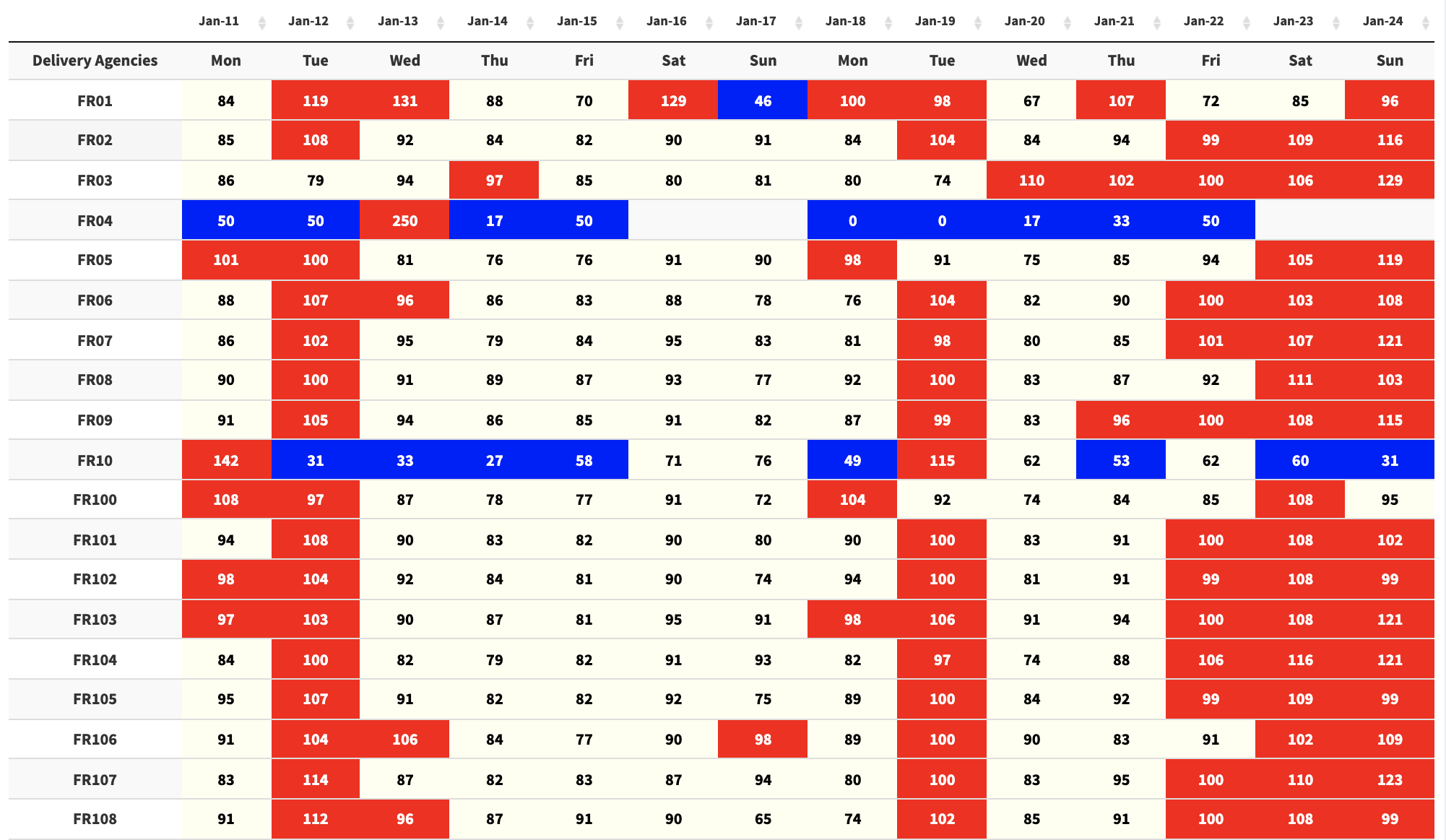

Figure 3 presents a forecast of capacity utilisation by delivery depot and date built based on the series of historical traffic and market events. The cells in red correspond to situations where/when the traffic is expected to reach practical planned capacity. For these dates it will be necessary to add additional capacity at a higher cost. The cells in white correspond to situations where/when the utilisation of planned capacity is predicted to be in an acceptable range. The cells in blue correspond to situations when/where the planned capacity is expected to have a low utilisation rate.

This enables pricing teams to identify in advance days and destinations with high capacity utilisation forecasts in order to apply a premium. The days and destinations with low capacity utilisation can be eligible to targeted incentives to increase share of wallet (cross-selling). This can also contribute to retaining customers with identified risk of attrition and rewarding customers honoring their volume commitments. These terms can be negotiated and included in the contract.

Figure 3: Capacity utilisation forecast by delivery depot and date

Contact our pricing experts to learn how Dynamic Pricing can be implemented in your company: www.openpricer.com/contact-us/

About the author

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.

Daniel Rueda is founder and CEO of Open Pricer. Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. Daniel has a strong expertise in Pricing and Revenue Management, starting in 1987 as Revenue Management Project Director at Air France. In 1991, he founded Optims, a leading provider of RMS for the Hospitality, now part of AmadeusGroup. Daniel has helped domestic and international parcel networks to optimise their prices, including: DHL Express, FedEx, TNT Express, La Poste-Colissimo, Chronopost, DPD, Aramex, Estafeta.