Quo Vadis? Where should postal operators go concerning the logistics business?

TNT announced the sale of its contract logistics business, whilst Deutsche Post World Net completed its acquisition of Exel, thus creating an uncontested global No. 1 position in both contract logistics and freight forwarding.

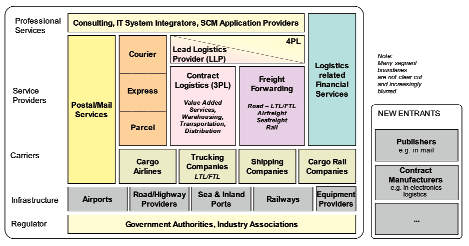

For years many postal operators’ boardroom discussions have centred around strategies to build and secure alternative sources of income, compensating for the anticipated decline in the core mail business. Entering the logistics business has been one of many debated strategic options in this context. The basic idea has been to invest in a business that, next to mail and parcel related services, would enable the postal operator to offer a one-stop shop for the transport, storage and distribution of physical goods of all sizes. This way, postal operators considered “moving right” on the industry’s strategic chessboard – see Figure 1.

Figure 1. Postal, express, logistics and transport industry framework

Booz Allen Hamilton©

The first postal operator to seriously pursue this strategy was Royal Dutch Post, acquiring the express parcels and logistics company TNT in 1996 (and ironically now the one who has announced its exit from the logistics business). What followed was a race with German Post, who implemented its aggressive expansion plan in the same direction by buying Danzas, AEI, DHL, Exel and numerous smaller logistics and express companies.

Fading enthusiasm, especially in contract logistics

Today, much of the original enthusiasm regarding alleged synergies between mail, express, contract logistics and freight forwarding has faded. Postal operators who embarked on the “one stop journey” had to realise how distinct the business models, competitive situation, customer needs, operational requirements and success factors of each segment were.

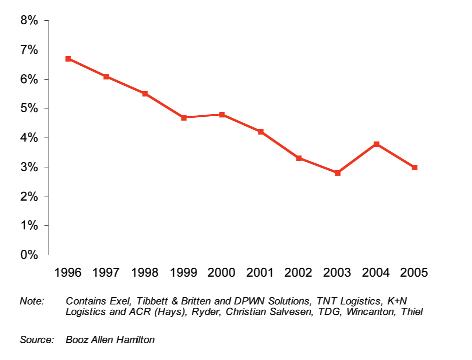

Figure 2. Operating margins in contract logistics -top ten players, 1996 – 2006

Especially in contract logistics (or 3PL), players have been faced with almost continuously declining operatingmargins, from close to 7% in 1996 down to 3-4% today (see Figure 2). Return on Capital Employed has taken a similar downward trend for the sector whilst Express and Freight Forwarding have displayed positive trends in recent years. The original vision of the 3PLs centred around “value added services” and “supply chain solutions business”, but today’s reality is that 3PLs did not succeed in escaping commoditisation. As a consequence, operational excellence, smart contract design and best practice sharing across contracts has become the name of the game.

Positively, the contract logistics industry is still exhibiting steady growth. In the US, value-added warehousing and distribution expanded to $22.3 billion in 2005 with 9.5% growth. One of the largest players, UTi Contract Logistics, grew by 37.5% and improved its net revenue margin to 7.9%.

A fierce competitive landscape

In considering any move into contract logistics, postal operators (especially smaller ones) need to acknowledge that the market is heavily contested by other players, whose core capabilities are much closer to serving the contract logistics market than those of traditional postal operators:

- Some Express companies such as UPS with its UPS Supply Chain Solutions Division have advanced into the contract logistics sector. Interestingly, UPS arch-rival FedEx remains doggedly focused on its core small package andlight road-freight businesses. Fred Smith, Chief Executive Officer of FedEx, recently explained: “We have looked long and hard at whether we want to be a big player in the contract logistics sector. We have chosen not to do so because it is a low margin business and it is not clear to us that there is the type of synergies there that our competitors hope to find.”

- Freight forwarders such as Kühne+Nagel just acquired ACR (former Hays) to further strengthen its contract logistics business. In general, all the major forwarding companies benefited from increased volumes which made them cash rich and acquisitive.

- Rail companies: Most recently Schenker, a division of Deutsche Bahn, acquired US based Bax Global, the forwarding subsidiary of Brinks and has announced further growth in contract logistics.

- Shipping companies such as Maersk, NYK and APL build logistics divisions which provide services such as consolidation at origin, and final distribution on a global basis.

So, in sum, the fragmented contract logistics market, estimated at around $173 billion, is and will be heavily contested in the years to come.

For postal companies, the decision regarding contract logistics is very much a business portfolio decision with wide-ranging consequences. What works for one postal company may not be suitable for another.

In Europe, some players have followed in the steps of DPWN and TNT, though on a much smaller scale. For example, Norway Post acquired Frigoscandia, a temperature-controlled third-party logistics and transport operator, and in early 2006 Finland Post acquired the Swedish logistics company Roadlink Spedition AB. The largest of the post offices in the Northern Europe region, Sweden Post (Posten) have historically pursued ambitions in logistics targeted at international expansion throughout the Baltic countries, Poland and Russia. Although they reversed this decision in 2003 they still pursue logistics activities.

Others have consciously decided to stay out of the logistics business and pursue other strategies. Italian Post, for example, used its profits from the mail business to significantly expand its financial services and retail business to optimise its branch network. Royal Mail and La Poste have decided to stay out of contract logistics but focus available funds on other business segments: Royal Mail through its acquisition of General Parcel, and La Poste (through subsidiary GeoPost) by taking a controlling interest in DPD.

In the US the story is quickly told: USPS’ 2006-2010 Strategic Transformation Plan does not make any reference to expanding the business into areas such as logistics services. The 3PL sector was very much developed by trucking, freight forwarding and warehouse companies and it is unlikely that USPS will play any role in the foreseeable future.

In Asia it remains to be seen whether postal operators will play any role in the growing logistics market. Any signs of ambition have been focused on alliances in the express market, e.g. Japan Post’s strategic cooperation with TNT, or the recent joint venture by Vietnam’s VNPT with DHL. Meanwhile, the logistics market continues its consolidation without postal operators playing any role like they did in Europe: Australian-based Toll Holdings’ absorption of arch-rival Patrick Corporation creates a new transport giant in the region with combined revenues of $4.2 billion and follows Toll’s acquisition of Singapore’s SembCorp Logistics a month earlier.

The Middle East growth region is characterised by largely underdeveloped postal operators whilst cash-rich logistics players emerge and take the market. Already Kuwaiti based PWC Logistics has acquired GeoLogistics as well as a number of other smaller forwarders and contract logistics activities. Aramex also has major development plans as has GAC Logistics.

In conclusion

TNT’s announced exit from contract logistics and DPWN’s acquisition of Exel has given new rise to the debate whether logistics has been a viable strategy to diversify from the core mail business. For large players such as DPWN, who were amongst the first movers in that direction, that certainly has been the case. For other postal companies, the logistics market should be viewed with caution.

The market is heavily contested and average margins (apart from niches) have been on a constant decline. Anyway, the boardroom agenda of most postal companies, especially in Europe with full liberation on the doorstep, is quite different:

- If the core mail business does not render profits, the discussion about serious investments in other business segments is almost obsolete.

- In any case, securing the core mail business against revenue decline and new competitors as efficiently as possible ranks probably highest on the agenda.

- Even where mail profits have generated the financial flexibility for strategic manoeuvres, investments into the mail value chain, international and foreign domestic mail flows, express services and retail-related activities are much closer to mail operators’ core capabilities (and often financially more attractive) than entering logistics.

The strategic options for postal operators are manifold. The global mail, express and logistics industry is an exciting playing field, a grand chess board, with its own players, rules and moves, surprises, moments of truth, disappointments and victories. It is a large game – so let’s play it and play it well.

Alexander Niehues is a Vice President of Booz Allen Hamilton and coordinates the firm’s global consulting activities in the postal and logistics sector. Booz Allen is a global strategy and technology consulting firm that works with clients to deliver results that endure. With more than 17,000 employees on six continents, the firm generates annual sales of over $3.6 billion. To learn more, visit the Booz Allen website at www.boozallen.com or www.strategy-business.com, the website for strategy+business, a quarterly journal sponsored by Booz Allen Hamilton.

What it means for postal companies around the globe