Japan Post makes $5bn offer for Australia’s Toll Group

Japan Post has made an audacious $5bn bid for Australian transport and logistics giant Toll Group, which could transform the logistics and e-commerce market in the Asia-Pacific region. Toll Group, which had sales of A$8.8bn ($6.9bn USD) and profits of A$293m ($229m USD) in 2014, said today that its board is unanimously recommending Japan Post’s cash offer of $9.04 per share.

The offer for all shares in the company values the whole of Melbourne-based Toll Group at A$6.5bn ($5.07bn USD).

If the acquisition goes ahead, Toll will be run as a division within Japan Post, retaining the Toll name, the company said, adding that it would be an “important step” by the state-owned postal operator to become a leading global logistics player.

Japan Post would effectively see its revenue swell by 30% by taking over Toll Group.

The deal is subject to shareholder approval, which will be formally sought in April, with a full shareholder vote expected in May 2015. To go ahead, the deal must win backing from 75% of shareholders, as well as regulatory approval.

The acquisition could be implemented in early June, the companies said.

Japan Post said that considering the shrinking postal market at home, it had to expand overseas to boost earnings. It said it was looking to focus on the “fast-expanding” Asian logistics market through the takeover.

It said Toll Group has a “strong presence” in the Asia-Pacific region in forwarding, third-party logistics and multinational corporate management.

“Transformational”

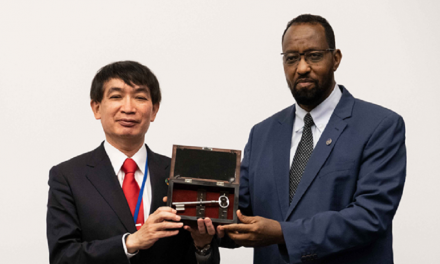

Toru Takahashi, the President and CEO of Japan Post, said: “We believe the combination of Japan Post and Toll will be a transformational transaction for both our companies and we are very pleased we have been able to reach agreement. In partnership with Toll we are starting a new chapter of looking outward and becoming a leading global player.”

Toll Group’s leading shareholders include funds of major banks including HSBC, JP Morgan, Citicorp and BNP Paribas, as well as former Toll managing director Paul Little.

The company’s major activities including logistics services for the energy industry, contract logistics for major corporations, freight and forwarding, and also express delivery. The company’s express division has recently been particularly working to build its business-to-consumer operations through the Toll Consumer Deliveries unit in Australia, which goes up against Australia Post in the e-commerce delivery market.

In its latest half-year results, out today, Toll Group saw its revenues for the first half of the 2015 fiscal year fall 2.6% year-on-year to A$4.41bn ($3.44bn USD), with net profit after tax down 22.3% year-on-year to A$136.6m ($106.5m USD).

The company has been investing in its fleet and in major new depot facilities to build on “strong” demand for logistics services in Australia.

Japan Post

Japan Post has been attempting to privatise for years, and in documents related to the Toll offer, it said it was currently expecting to go public in or after late in the 2015 financial year.

Currently 100% government-owned, Japan Post Holdings has revenue of about $127bn USD, much of it generated from insurance products. The company is divided into three businesses – Japan Post Co., Japan Post Bank and Japan Post Insurance.

Toll Group would form part of Japan Post Co., the takeover growing the Post’s revenue by almost 30% from about $23.2bn USD to about $30bn.

Toll Group said Japan Post’s offer represented a 49% premium on yesterday’s closing share price.

Toll Group CEO Brian Kruger is expected to remain in place following the takeover, reporting to Japan Post CEO Toru Takahashi.

Kruger said: “The proposed combination is a reflection of the strategic value of our business and our strong footprint throughout the Asia Pacific region. It will deliver great opportunities for our staff, customers and strategic partners. The great Toll culture built on safety and operational excellence will work well alongside Japan Post’s established values. I am delighted to have been invited to lead this powerful new division of Japan Post and look forward to working with the rest of the group.”

Amazing, excellent move as long as though JP leave it alone. The culture of freight forwarding and logistics is the antithesis of managing a postal network. When Dutch Post/TNT bought a forwarder, the wrong one in the wrong place it did not work.

Toll seems big and global enough to stand alone and is probably reaching it’s peak in motivation of management so it is a good time to sell.