How should parcel networks reposition their prices?

Open Pricer, provider of price optimisation software for logistics networks has conducted research with major actors of the industry to evaluate the impact of the Covid-19 crisis and design solutions.

We share insights in a white paper that can be requested here. This excerpt explains how carriers should manage price repositioning.

As reported by Fortune columnist Geoff Colvin (referring to the 2009 recession) : “One of the most important decisions in this recession is what to do about prices. In booms you don’t have to get pricing exactly right. Now you do. Decide carefully, because you’ll be living with the consequences for a long time.” (Geoff Colvin, “Yes, You Can Raise Prices”, Fortune, March 2, 2009).

The Covid-19 pandemic has led to the highest level of e-commerce in years and a major change of business mix due for parcel carriers to the explosion of B2C and the decrease of B2B volumes. The impacts are: (i) higher costs and the need to reposition prices to recover margins; (ii) higher attrition risk and the need to retain customers who have suffered from the crisis and may seek cheaper transport alternatives.

Cover additional costs and recover profitability

For most carriers, the Covid-19 crisis often involves complex adjustments to capacity and transportation plans resulting in increased operating costs. The increase in B2C volumes leads to three main effects:

- Lower average weight per parcel (resulting in lower rate per parcel);

- Lower delivery densities (parcels per delivery stop) resulting in higher delivery costs – in the majority of cases, except for certain geographic areas which already have a high delivery density where the effect is the opposite;

- Increased volumes in peak periods resulting in the need to increase network capacity at higher marginal cost.

In order to cover these additional costs carriers are designing rate increase campaigns more ambitious than in the past. To be successful these campaigns should be based on two principles:

- Price increases should be differentiated by customer based on tangible factors, notably how the current price compares to the price of similar customers (“fair price”);

- Campaigns should consider the risk of attrition and churn in order to retain profitable customers.

How to frame the price increase?

Formulating a price increase in percent of total revenue is not the easiest method. This puts emphasis on price, not costs. It is easier to link a surcharge to a cost driver, such as the number of parcels or the number of delivery stops. We recommend to define different possible surcharge formulas and simulate their revenue impact by customer and globally on significant month(s) of traffic with the following objectives and constraints:

- Obtain an additional amount of revenue to offset the total increase in costs;

- Do not exceed a given threshold of % price increase per customer (this % may vary depending on customer revenue tier, product, destination, etc.);

- Compare with the simulation of competitors’ surcharges if the corresponding formulas have already been published.

Price increases must be justified in clear terms in relation to cost drivers. Customer resistance will occur and should be managed carefully to avoid attrition. For example a customer with a high value for the company and with a price higher than its “fair price” (i.e. the price of similar customers) could be exempted or receive a lower surcharge.

Retain profitable customers

Churn (loss of customers) and attrition (reduction in volumes) are key risks to manage in the current context. Due to strain on their balance sheets, some shippers will try to reduce their logistics costs. This can take the form of contract renegotiation request, tenders resubmission or switch without notice to lower cost competitors.

How to respond to customers’ price reduction requests?

These requests may arise at any time and put the sales and pricing teams under pressure because customers expect a quick answer (some of them will already have proposals from competitors on hand). In order to provide effective and quick responses, it is recommended to prepare in advance of potential negotiations, detailed rerating pricing strategies for each customer. The steps are:

- Step 1. Evaluate key decision factors: (a) Customer Lifetime Value and (b) Risk of Attrition/Churn

- Step 2. Define target and defensive pricing strategies based on these factors

- Step 3. Conduct effective negotiations with guardrails and what-if-analysis (scenarios)

Step 1.a. Evaluate Customer LifeTime Value (LTV). LTV measures how important a customer is for the company (at the current price). It results from the consideration of different factors: price, cost of service, expected growth and expected lifetime. A large customer with high price, low cost of service, growing trade and loyal for many years will be at the top of the scale. A small customer with low price, high cost of service, occasional trade for less than one year will be at the bottom of the scale.

Step 1.b. Evaluate the Risk of Attrition/Churn (RAC). RAC measures the probability that a customer decreases or stops its trade if a price decrease is denied.

The factors that can be used to evaluate LTV and RAC and the corresponding sources of information are presented in the full version of the study available on Open Pricer’s website.

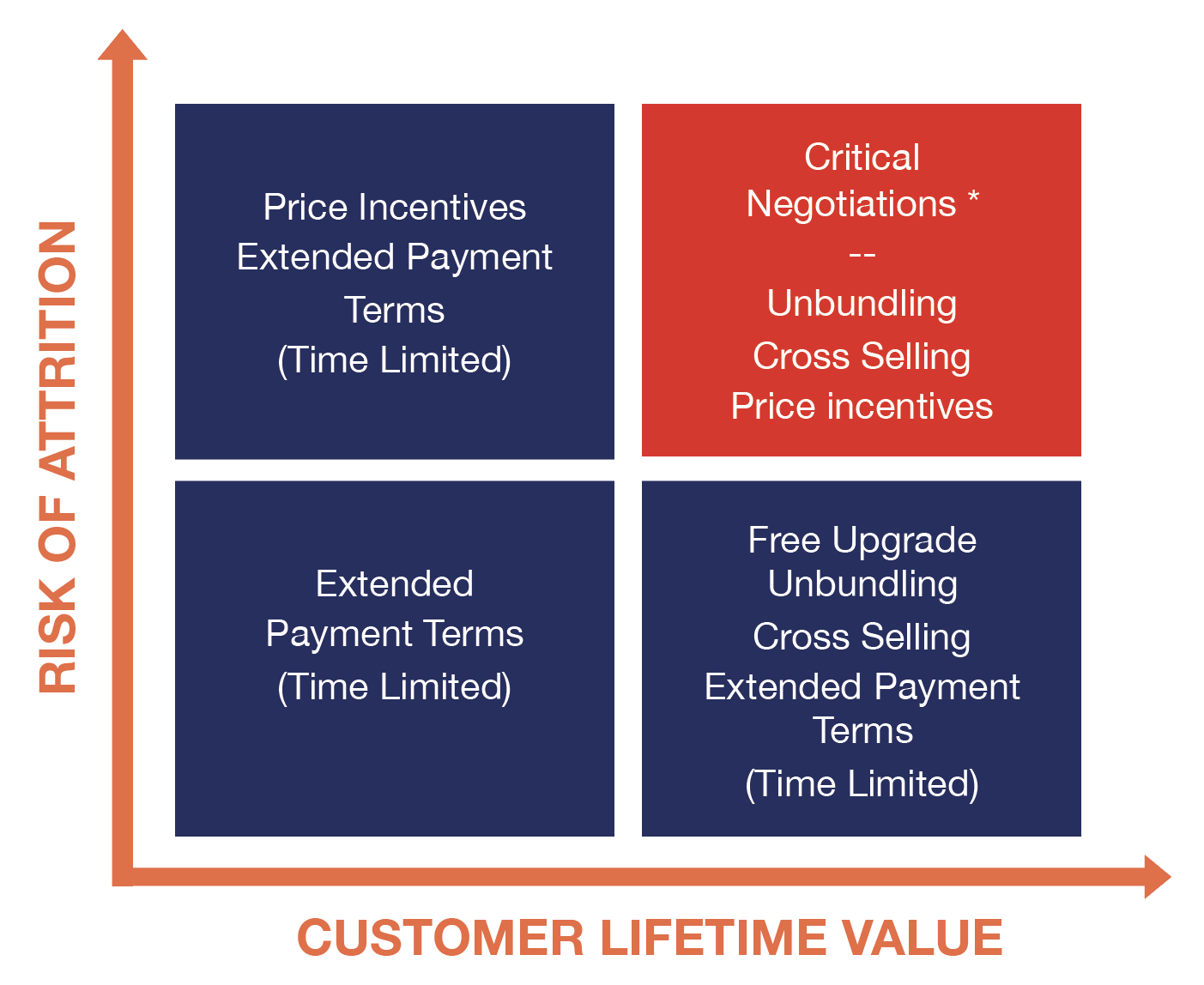

Step 2. Define target and defensive pricing strategies. We recommend setting target and defensive strategies using a decision tree. Each node of the tree will correspond to a split according to the value of a decision factor (LTV, RAC or other factor) and each terminal leaf will correspond to a strategy (target price[1], defence price[2] and other Terms and Conditions). Figure 1 illustrates a simple 4-leaves decision tree. More elaborate strategies can be defined by adding other factors (such as Revenue Tier, Fairness of the Request, etc.). Decision rules for tier XL/L customers should be more sophisticated and involve more factors (Consequence of Losing Contract, Economic Value, Competitive Offers, Switching Costs, etc.).

Figure 1: Target and Defensive Pricing Strategies

(Simple 4-Leaves Decision Tree – Illustrative)

- The target price is the objective set for the negotiation based on the price of similar customers/deals and a margin target

- The defence price is the minimum price set for the negotiation based on the price of similar customers/deals and a minimum margin target.

Step 3. Conduct effective negotiations with guardrails and what-if-analyses (scenarios). The decision tree assigns a given negotiation strategy to each customer. When asked for a price incentive, the sales managers can access a Rerating Dashboard showing the information already gathered and the missing information that they must fill in order to get the adequate rerating strategy.

As shown in Figure 1, price is not the only negotiation variable. An effective negotiation strategy should also consider other variables that decrease the costs for the carrier and increase the benefits for the customer and result in a lower probability of attrition/churn. For example:

- Extended payment terms: are appropriate if the customer is facing a liquidity issue.

- Service downgrade/unbundling: has the triple advantage of (i) defending the value of the service, (ii) providing the customer a trade-off between price and value and (iii) limiting the impact on margin as costs can be reduced.

- Incentives that help increase volume (such as Cross selling): if the customer is already working with competitors for some products, destinations, types of shipments, then the share of wallet may be increased, leading to a win-win scenario: a lower price for the customer in return for an increase in volumes and a higher gross margin for the carrier (because the additional volumes will benefit from economies of scale).

- Free service upgrade: improves the value for the customer and creates a competitive advantage without decreasing prices.

It is recommended to provide sales teams with simulation tools enabling them to predict, based on customer specific shipment profile, the impact of pricing strategies on revenue and margin. Typical examples:

- What would be the impact on margin of a cross-sell strategy: e.g. a 10% price decrease for a 30% volume increase (more volume for new products, destinations, weight bands)?

- What would be the impact on revenue and margin if, instead of granting a flat % price discount, the price incentive is tweaked by product, destination and weight band?These simulations require to implement an intelligent CPQ system[3]. They enable sales teams to negotiate win-win deals, thus reducing margin dilution and customer attrition.

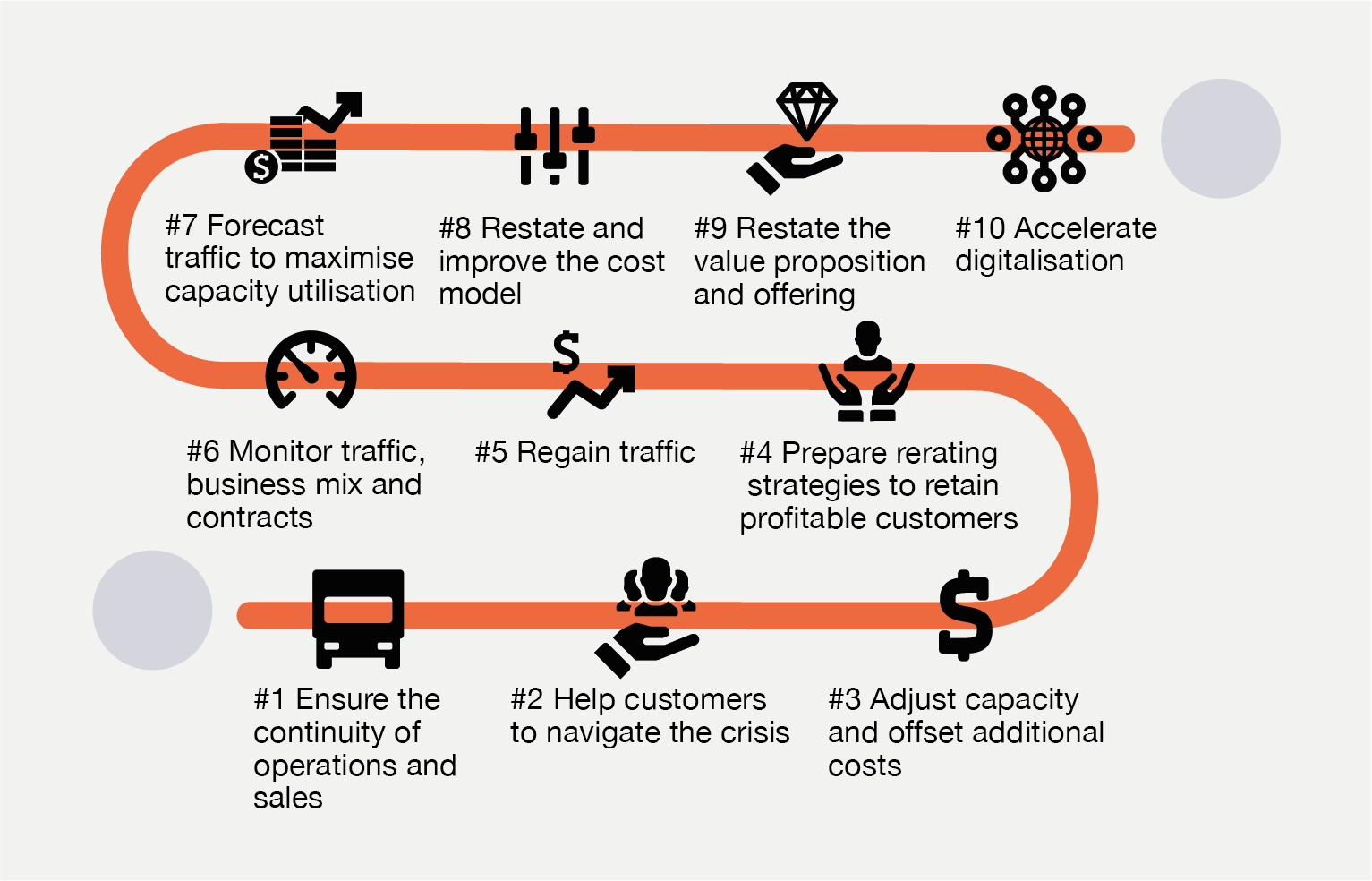

The 10 Solutions to Recover and Strengthen

Two last recommendations for price incentives:

- They should be limited in time with tangible conditions to restore the initial price (with reference to published trade activity indicators)

- A customer commitment in terms of minimum volume/revenue or provision of collaborative forecast helping the carrier to limit the impact on profitability should be set in the agreement.

You can request the full white paper describing the 10 solutions here.

The 10 Solutions to Recover and Strengthen

For more information visit www.openpricer.com

About Open Pricer: Open Pricer provides a cloud-based pricing platform that empowers businesses to sell smarter and faster, thus improving their financial performance. This solution is based on our extensive experience gained from working for many years with global market leaders. It will help your teams to improve pricing strategy, build more accurate quotes, optimize price increase campaigns, effectively monitor contracts to retain customers and maximize their lifetime value.