Getting ready for the IOSS and other new trade regulations with the EU

On July 1st, 2021 the way exporting goods to the European Union works gets a complete overhaul. If you want to keep selling goods to customers in the EU, you must adapt for new rules governing taxation and customs declarations. Alexander Maasik, Head of Communications at Eurora – an intelligent cross border compliance platform for e-commerce marketplaces and carriers- says you need to do it fast or risk losing all your business in the EU.

“Online shops don’t need to build new automated systems for themselves. Instead, they can implement a platform like Eurora, that addresses upcoming challenge holistically with a scientific and comprehensive approach.

Eurora’s automated AI-based solutions allow companies to save time and resources while handling large amounts of data precisely and near-instantly.

Changes to VAT.

Starting this summer, Non-EU online stores will have to collect and pay VAT (Value Added Tax) on all goods ordered by residents of the EU based on the VAT rate of the destination country. Every EU consumer must be able to see information on taxes for goods added from an online shopping cart. That means, online shops will have to start calculating VAT based on each product’s category and country of destination.

E-commerce businesses must now be aware of all the tax rates and import restrictions in all the different countries they want to send goods to. So, to send goods to more countries, one must use an automated system that knows all the different tax rates.

All goods must be declared.

Another new requirement for logistics companies is that now all consignments must be declared when entering the EU. The amount of declarations in the EU border is estimated to grow from 2 billion to 6 or 8 billion.

Unless the process of custom clearance becomes much faster than it is now, the huge number of declarations mean that goods will pile in warehouses of postal operators and courier companies. And that will slow the process even more. For the system to not fail, both marketplaces and logistic companies need to implement new automated platforms.

Eurora helps you handle these changes.

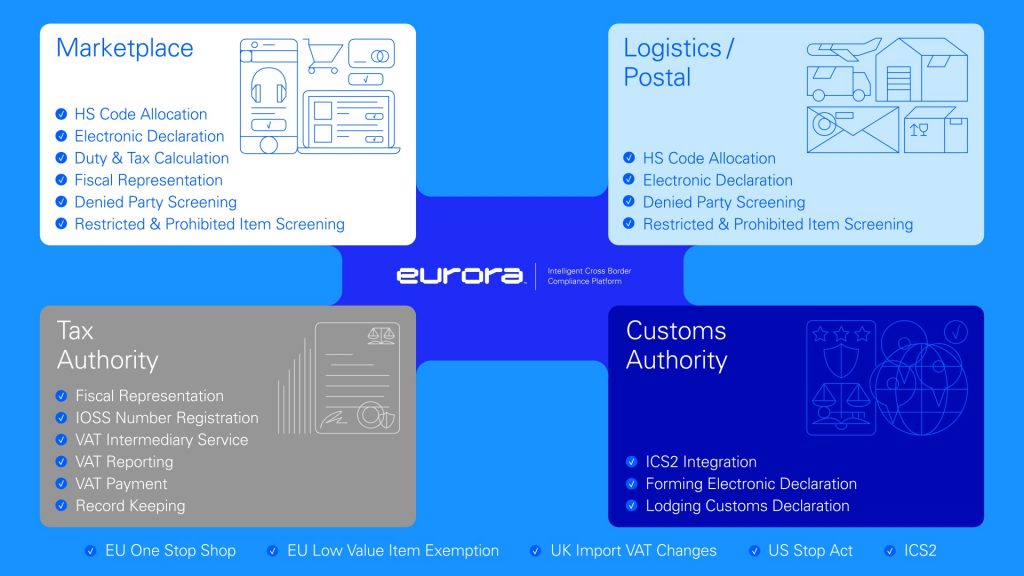

Eurora is the only solution that can help you handle all of these new regulations. From electronic declarations to fiscal representation and record keeping, Eurora does it all.

Work on Eurora’s Intelligent Cross Border Compliance Platform started right away when the EU announced their plans over 3 years ago. Eurora has been working with top universities and scientists to build a holistic platform on which all the services have been scientifically proven to work.

The entire system has been designed to automatically assign HS and TARIC codes to packages, calculate duties and taxes for most countries in the world, check for prohibited and restricted items, and submit electronic declarations to customs. What is more, Eurora can act as a VAT representative in the EU to handle all VAT payments and recordkeeping for your company.

Your personal representative in the EU.

New regulations require companies to register a company in the EU or have a tax representative who handles all VAT declarations and payments. Eurora’s platform can easily generate the necessary input for VAT declarations from sales data and also act as a tax representative for any company selling goods to the EU. This is a much cheaper and easier option than registering a company in EU yourself.

Learn from past mistakes.

If we can learn anything from the logistical chaos that was Brexit, it is that online shops and marketplaces must do everything they can before new rules apply or disruptions are inevitable. After all, the EU is the UK’s biggest trading partner, so if marketplaces are not ready by July, the chaos that companies and consumers faced in January, will seem small in comparison. However, for companies who rise up to the challenge, the new rules are an opportunity for growth.”

If you want to be up to date with all upcoming regulatory changes, make sure to sign up for the Eurora Newsletter as well.