How to secure long term profitability

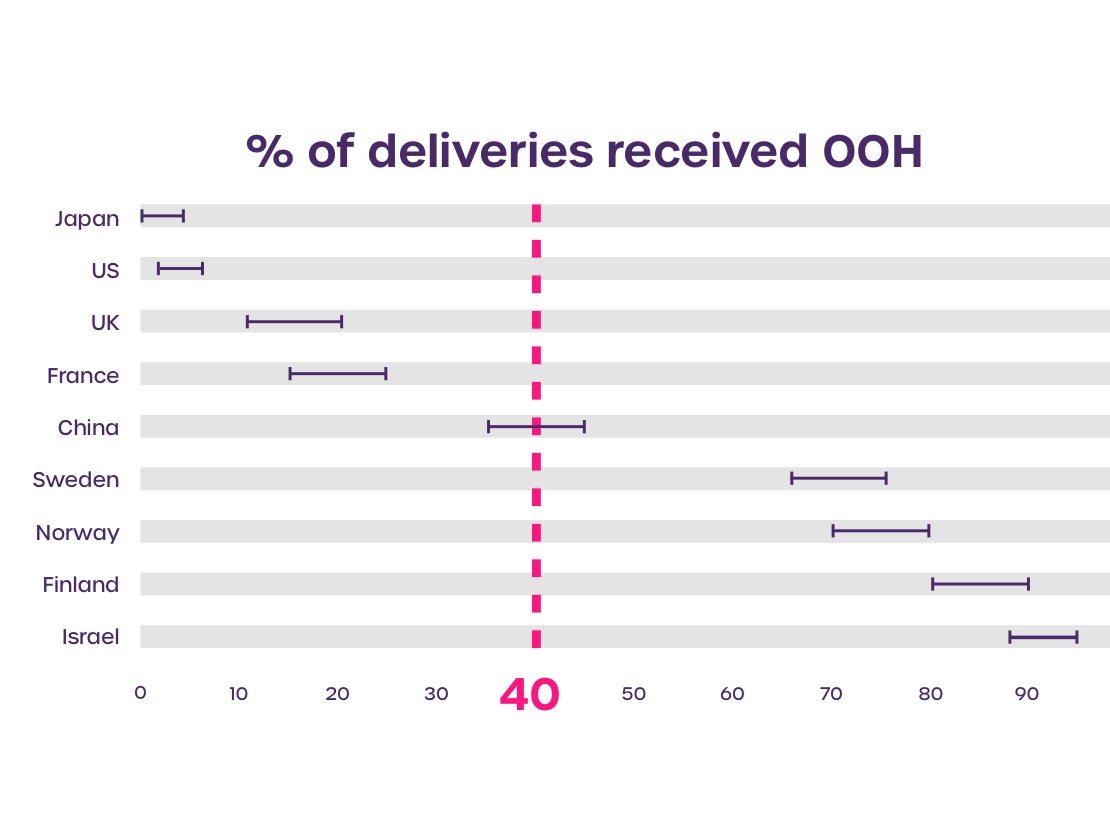

Mike Richmond, Chief Revenue Officer – Carriers at Doddle – explains why out-of-home delivery will reach 40% of volume in all markets.

“As e-commerce markets around the world exit their growth phase and become mature, they will trend towards a delivery ratio where 40% of deliveries are delivered out of home, as the needs of carriers and consumers balance out and reach a stable equilibrium.

That’s a relatively bold statement with material implications – so let me explain why we see this happening.

First, we need to understand the nature of the market. E-commerce remains a growth market more or less across the board. There has consistently been over 10% year-on-year e-commerce growth in almost every country, dating back to the 2008 global financial crisis.

Growth markets are curious beasts, allowing participants to continually sacrifice profitability at the altar of growth. The consequence in the parcel logistics industry is rapid scaling and a chase for the seemingly endless tide of new online parcels, without a consistent focus on what impact that is having on the bottom line.

As that e-commerce growth starts to taper off – which it will eventually, as crazy as that sounds amidst the current boom – and the market approaches maturity, growth will be harder to come by.

Businesses will start looking to optimise their current operations to seek efficiencies. In other words, carriers will start to look at the bottom line rather than the top line.

Now, there are lots of ways to improve efficiency, but we’re interested in the last mile for two reasons: first, it’s a huge determinant of overall costs – commentators regularly settle on 40% of overall logistics cost – and second, it’s a huge determinant of retail success in e-commerce because it represents the most important moment in the whole e-commerce experience for consumers.

When parcel carriers look to remove inefficiency in the last mile, home delivery is going to become a target. Delivering individual parcels to individual consumers who live increasingly mobile lives is a headache. Whether it’s the long distances between those deliveries leading to low drop density, the increasing incidence of parcel theft – a recent New York Times article suggests 90,000 parcels per day go ‘missing’ in New York City – or the challenge of missed / failed delivery attempts, residential deliveries have some fundamental challenges. And when compared to out of home (OOH) deliveries (i.e. those consolidated deliveries of multiple items going to B2B locations like parcel shops, pick up points and lockers) home deliveries can appear hugely inefficient and expensive.

Put simply, reducing the percentage of residential deliveries will be a massive driver of profitability for carriers in a market where volume growth has slowed down. As a result of this, carriers today are already looking to increase their out-of-home delivery ratio as a strategic priority, to help secure their profitability in the long term.

Why 40%?

Data from around the world shows markets in very different states when it comes to out of home vs home delivery.

In markets where out of home delivery is less than 40% of volume, carriers are setting strategic targets to increase consolidation and investing in growing their OOH networks, seeking to improve customer experience and drive increased uptake by shoppers.

However, the reverse is also happening. In places like Sweden and elsewhere in the Nordics, out of home delivery is the norm, with around two thirds of deliveries typically occurring out of home. In those markets, home delivery rates are increasing as parcel carriers seek to improve their home delivery propositions in response to rising consumer demand.

These two trajectories imply an equilibrium exists where the ratio of home delivery to out of home delivery satisfies both consumers and carriers, on the one hand offering enough convenience through home delivery to consumers, and on the other ensuring the right balance between B2B and B2C deliveries to allow for profitable growth on the part of the carriers.

So where will this equilibrium settle? Well, based on analysis of current trends in delivery destination in over 25 markets and a global analysis of growth rates of OOH networks, we believe that markets will settle at 40% of parcels being delivered to OOH. And a key validation of that prediction already exists in the most mature market of them all – China. Analysts already expect e-commerce to contribute more than 50% to retail sales in China in 2021, placing it head and shoulders above any Western market in terms of e-commerce maturity. How do Chinese carriers manage that volume and remain profitable? Around 40% of their volume goes to out of home locations.

Balancing out the market

The driver of home delivery volume is very simple – convenience appeals to consumers. I do not have to leave my house to receive my order and I am confident that if a parcel goes missing, I will be fully reimbursed.

The driver for increased out of home delivery is the desire for carriers to improve efficiency in the last mile. Consolidated deliveries can effectively make B2C parcel deliveries look more like B2B deliveries, which are far more profitable for the carrier. In markets where the carrier has more control over the delivery option used, such as China, out of home delivery is much more prevalent. In Chinese cities, delivery drivers have the option to re-route the delivery to a nearby parcel locker if the consumer isn’t immediately available to receive delivery and that is the main driver of the fact that 40% of Chinese parcel deliveries end up out of home.

So at a very simplified level, consumers want more home delivery and carriers want to deliver more to out of home. In a market like the UK there’s a disconnect between those forces as, like in many markets, pricing of home delivery to consumers does not reflect its cost to carriers. Largely, this is because of the price-depressing role played by giant retailers like Amazon who have increased consumer expectations around delivery standards and pricing. That disparity between pricing and cost is manageable for the time being, because the market as a whole is growing and enabling carriers to profit regardless – but that tune will change eventually. When growth slows, the price function will have to come into play again, and it will incentivise retailers and consumers to adopt more out of home delivery.

In addition, the value consumers place on home delivery is sensitive to factors beyond price. For example, the convenience of home delivery is affected by how much time you spend at home. As the pandemic is brought under control, consumers will be less likely to be at home and failed deliveries will rise again. Other factors affecting the value of home delivery include environmental consciousness – if shoppers are seriously concerned about their ecological impact, they might be open to messaging around the emissions-reducing value of consolidated delivery options.

Clearly carriers have the ability to influence some of those factors, particularly by improving their own out of home networks to offer a customer experience and convenience factor that brings them closer in comparison with home delivery. They could also advertise the efficiency and emissions benefits to show consumers that choosing out of home deliveries results in fewer miles driven and reduced CO2 emissions. By taking these approaches carriers can try to mediate the desire of consumers for home delivery and make out of home a more attractive option.

Changing incentives

Perhaps the biggest question is how to get consumers on board with receiving fewer deliveries right on their doorstep, in countries where home delivery has become the de facto delivery option. The classical economic answer is simply that home delivery will eventually have to be accurately priced to account for its costs, which will reduce demand – but consumers are so used to free or low-cost delivery, and expectations are only climbing.

What carriers can do to ease the burden is to accurately reflect the differences in consolidated and home deliveries in their pricing to retailers, so that retailers can offer still offer free and fast deliveries, and still offer home deliveries – just not both at once. If carriers raise home delivery prices but offer discounts for deliveries into post offices, parcel lockers and parcel shops, retailers can encourage consumers to adopt these delivery methods by keeping them cheap and raising the price of home delivery.

The more extreme example of this is carriers offering a PUDO only service. It might seem scarcely believable to some, but it’s not unheard of. In March of this year, Poczta Polska announced a new delivery partnership with a health and beauty retailer that currently only includes out of home delivery options, offering 24-hour turnarounds.

That’s one example of the ways in which consolidated delivery could represent a way for retailers to sustainably offer key aspects of the modern delivery expectation by reducing the cost per parcel. That relies on the carrier passing on the discount, but this is already commonplace in markets like France, the Nordics and Poland.

Another alternative incentivisation approach is for carriers to reduce basket thresholds for OOH options. In the UK, items sold on Amazon as “fulfilled by Amazon” have a minimum threshold basket value of £10. That minimum is waived for items which are delivered to an Amazon Hub location (i.e. one of their parcelshops or locker locations). This shows how a very customer-friendly delivery option (free delivery of a single small item) can be enabled by consolidation. This is undoubtedly made easier for Amazon because in this instance they are acting as both retailer and carrier, so they see the value on both sides.

Scratch my back and I’ll scratch yours

We’re looking some distance into the future with this topic, which means there’s plenty of time for posts and carriers to strategically prepare. There’s a huge opportunity for carriers and posts who are currently on opposite ends of the spectrum to share knowledge and understanding. Carriers who mainly deliver to service points and parcel shops can educate those who are primarily delivering to home addresses on how best to operate an out of home network, and vice versa those with home delivery expertise can offer insight for those who are currently investing in a better home delivery proposition.”

About the author

Mike Richmond is responsible for Doddle’s relationships with postal organisations and parcel carriers globally. You can find more from Mike on the Doddle website or on LinkedIn, or email him at [email protected].

Mike Richmond is responsible for Doddle’s relationships with postal organisations and parcel carriers globally. You can find more from Mike on the Doddle website or on LinkedIn, or email him at [email protected].