How to achieve effective parcel locker deployment

Doddle’s Chief Commercial Officer, Mike Richmond on the path to parcel locker success.

“Parcel lockers have been making industry headlines for years. Offering carriers and posts automation, parcel consolidation and increased efficiency in the face of growing parcel volumes, it’s easy to see why they are an attractive option to invest in. According to Analysys Mason, in the UK alone, growing demand for parcel lockers will result in the deployment of over 50,000 APMs (Automated Parcel Machines) before 2030, with a cumulative investment of £1 billion.

However, parcel lockers aren’t always a success. Many factors can prevent parcel lockers from getting a foothold, including the geography of the network, the locker density and proximity to consumers, as well as how the lockers are promoted to both merchants and consumers. In our latest report, Parcel Lockers: Key Questions Answered we explored all aspects of parcel lockers, looking at their successes, failures, consumer perceptions and more. This is what we’ve learned about why lockers can sometimes struggle to get a foothold and the keys to effective deployment.

Where have lockers been successful?

In terms of sheer size and volume, China has the largest network of ~400,000 lockers, with the majority owned by Hive Box. Owning approximately 300,000 lockers in some 200 Chinese cities, Hive Box processes over 20 million parcels daily, making it the biggest parcel locker operator in the world.

However, despite its sheer size, it’s unclear whether the company is turning a profit on this network – as the latest disclosed financials (from 2021’s $400 million funding round) reported a loss of around $130 million USD across the first three quarters of 2020. Hive Box has also faced controversies with Chinese consumers, with carriers re-routing parcels to lockers without consent to save time making home delivery stops. It’s unclear whether this consumer dissatisfaction will impact Hive Box’s performance, or if the massive investments made into its locker network will eventually lead to profit and long-term success.

Poland is also a major leader in the locker market, with 43% of parcels going through InPost’s 20,000 APMs (Automated Parcel Machines). Of its 17 million users, InPost reports that 20% receive or send more than 40 parcels yearly. The company also reports that 95% of its parcels are delivered next-day, 59% of the country lives within a 7-minute walk from an APM, and collections take around 7 seconds. Unlike Hive Box, we know how financially successful InPost is – it generated nearly half a billion USD in EBITDA in 2022.

Poland is also a major leader in the locker market, with 43% of parcels going through InPost’s 20,000 APMs (Automated Parcel Machines). Of its 17 million users, InPost reports that 20% receive or send more than 40 parcels yearly. The company also reports that 95% of its parcels are delivered next-day, 59% of the country lives within a 7-minute walk from an APM, and collections take around 7 seconds. Unlike Hive Box, we know how financially successful InPost is – it generated nearly half a billion USD in EBITDA in 2022.

Perhaps the single most important learning to take from InPost’s success is that it has consistently incentivised merchants to take on the role of promoting lockers as a delivery and returns method. For outbound deliveries in Poland, APMs are ~25% cheaper for merchants than home delivery, meaning that retailers tangibly benefit every time they can convince a shopper to try out locker deliveries.

In turn, that promotion drives wider adoption, and consumers seem to have a better experience with APMs than any other delivery format – according to both InPost and other carriers who have shared NPS data with Doddle. So merchants are incentivised to push APMs, consumers have a better experience, making them more likely to repurchase with the merchant (and keep using lockers), and InPost volume grows over time as this flywheel turns, continuing to enable the consolidation benefits of lockers that allow it to offer the discounted rates in the first place.

Elsewhere, parcel lockers are also prevalent in the Nordics and in specific Eastern European countries. For example, DPD figures indicate that parcel lockers are the most-used delivery method in Estonia, preferred by over 80% of online shoppers, whereas under 60% prefer home delivery. The countries that had higher consumer preference for lockers were also the nations where lockers are widely accessible and cheaper than home delivery, and where home delivery has not historically been a default option for shoppers.

Once again, money talks when it comes to locker usage. In these markets, locker delivery is cheaper and much more likely to be positioned as the default option by merchants on their checkouts. The combination of familiarity, ease of access and price incentives drives massive locker adoption.

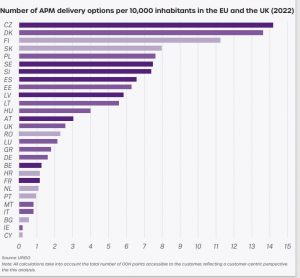

This chart from the Last Mile Experts’ 2023 European OOH report exemplifies the importance of dense coverage, showing the top 5 countries with the most lockers per 10,000 inhabitants are Czechia, Denmark, Finland, Slovakia and Poland. Unsurprisingly, these are markets with the highest levels of consumer adoption of parcel lockers.

Urban vs rural locker deployment

Our research has shown that the best-performing out-of-home networks are those in urban areas. Given the increasing complexities of home deliveries and increasing problems associated with parcel theft, parcel lockers provide those in urban geographies with a safer and more reliable delivery alternative to home delivery.

On the carrier side, if locker effectiveness is measured by maximising parcel consolidation and volume, then lockers are most effective in geographies where one locker bank can serve the maximum number of people within a short walk, or as part of a daily journey. The closer in proximity lockers are to users’ homes and workplaces, the easier it will be to drive adoption and repeat usage through higher awareness and convenience of the lockers.

Increased network density also correlates to improved performance. Swipbox’s Brian Jonasson says that users pick up parcels 3-6 times faster than average in urban areas and major cities with a large concentration of people and dense parcel locker networks. Because shoppers collect their parcels more quickly, the lockers can be utilised again faster, thus improving capacity.

Although parcel lockers tend to do well in urban areas, rural deployment should not be ignored. In fact, lockers are arguably the most suited to rural areas from a carrier perspective, where drop density is so low that the carrier can save costs massively on a per-parcel basis by consolidating deliveries.

However, without the density and consumer proximity, encouraging adoption in rural areas will be a harder task to achieve. One method of achieving this would be to pass on the cost-saving benefits of consolidated delivery to consumers using an equation that links cost, drop density and price. For example, a consumer in a rural area could still pay $10 for a home delivery, but could save $5 on that price by collecting a delivery from a locker or post office next time they’re in town. This model has been adopted successfully in markets with comparatively low population density like Finland, where well over 70% of all ecommerce orders are picked up.

Despite the Finnish example, this type of dynamic pricing is not something we see in the market more generally… yet. As with many of the other areas of ecommerce that are being ‘optimised’ in 2023, we think it’s only a matter of time.

Lockers are a long-term strategy

Geography does play a key role in locker network success. However, the principal causes of a network failure have more to do with commitment and short-termism than the fundamental unsuitability of lockers.

Reviewing some of the locker failures in Dubai, Spain, Ireland, the UK and elsewhere, many of these failures have resulted from pilots or proof-of-concepts, where they were killed as an expensive folly before they even had a chance to be adopted by consumers. Lockers are an expensive investment, with costs varying from c. $6,000 USD on the low end to $15,000-$20,000 for a 6/7 column locker bank with a touchscreen, security features and 40-50 compartments. But as well as the upfront cost, they will also incur running costs for power, Internet access and maintenance, which can be as high as 10% of the initial capex cost per year. With such high costs, it can take years for lockers to become profitable – which we’ve seen from InPost’s strategy and how Hive Box might still be waiting for the tide to turn.

Reviewing some of the locker failures in Dubai, Spain, Ireland, the UK and elsewhere, many of these failures have resulted from pilots or proof-of-concepts, where they were killed as an expensive folly before they even had a chance to be adopted by consumers. Lockers are an expensive investment, with costs varying from c. $6,000 USD on the low end to $15,000-$20,000 for a 6/7 column locker bank with a touchscreen, security features and 40-50 compartments. But as well as the upfront cost, they will also incur running costs for power, Internet access and maintenance, which can be as high as 10% of the initial capex cost per year. With such high costs, it can take years for lockers to become profitable – which we’ve seen from InPost’s strategy and how Hive Box might still be waiting for the tide to turn.

However, consumers respond very positively to parcel lockers, which offer flexibility, security and convenience in ways that home deliveries aren’t always able to. Carrier data from different markets continues to show that lockers have the highest NPS of any delivery method for those businesses. Consumers like using lockers – but they need time to adopt and realise the benefits for themselves.

If carriers and posts want to deploy a successful locker network, they need a long-term strategy in place to support that initial cost with both marketing and merchant support – ideally offering merchants some financial reward for driving volume to lockers, as this is what is most likely to make them take serious action.

Amazon has the luxury of being both merchant and last-mile carrier, so it doesn’t have to convince a third party to incentivise locker adoption on its behalf. Amazon offered consumers £5 (in the UK, $10 in the US) vouchers in exchange for picking up orders from its locker network for the first time. This cost was worth it for Amazon, which knew that consumers who experienced the lockers for themselves would more likely become repeat users in the future. Amazon also changed its checkout and product pages to promote pickup options more prominently to encourage this behaviour change.

Most carriers will have to overcome some friction to drive such changes on merchant checkouts, product pages and delivery options, but by sharing the benefits of consolidation as InPost has done, they could ensure that their investments in parcel lockers see returns.”

More information on parcel lockers can be found in Doddle’s latest report, ‘Parcel Lockers: Key Questions Answered’, available on the Doddle website.