Time to Challenge Your Pricing Model

This article is an extract from the Winter Edition of MER Magazine published in August 2018. You can read the full article as well as other articles from MER for free by visiting digital.mailandexpressreview.com.

Daniel Rueda is founder and CEO of Open Pricer, a provider of price optimisation services for parcel networks. In this article, Daniel explains how parcel networks can improve their margins thanks to a systematic and more precise management of discounts.

Sales teams often offer aggressive discounts to close contracts, resulting in an unnecessary dilution of margin. Conversely, some profitable deals are lost due to an inflexible application of the discount policy. We first present the pricing models commonly used by parcel networks and a typical example of profit leakage. Next, we explain how to control discounts and leverage sales data to improve their accuracy with a typical effect of 2 to 4 points of additional EBIT.

Usual pricing models

The pricing models most commonly used by parcel networks consist in:

- A standard tariff per parcel (or per shipment) for each product, with rate variation by weight band, origin zone and destination zone;

- A volume or revenue based discount.

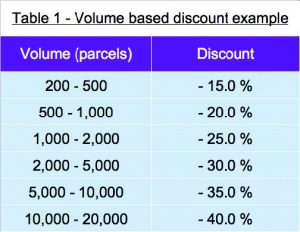

The term “volume” corresponds to the number of parcels or shipments per month or per year for a given product or for a set of products. Table 1 shows an example of a volume

based discount.

Table 1 – Volume based discount example

Volume based discounts are very popular in the industry (the more you ship the more discount you get), but lead to unjustified prices for several reasons:

A given number of light-weight or short-distance parcels get the same discount as the same number of heavy-weight or long-distance parcels whereas their contribution is much lower;

Discounts may exceed economies of scale, thus increasing the risk that your biggest contracts become loss makers.

A better practice is to discount based on revenue.

It is not recommended to use the budget declared by the customer (net revenue) because when we simulate the applicable tariff on the shipment profile we often find significant gaps with the declared budget. These gaps correspond to money left on negotiation table. For example, the customer declares a budget of €3,200 and is granted 30% off the standard tariff based on the discount policy. However, once simulated on its actual shipment profile we obtain a net revenue of €3,040 (-5% versus budget).

For this reason, it is a better practice to discount on the basis of gross revenue i.e. the revenue obtained by simulation of the standard tariff without discount on the shipment profile.

Profit leakage: a typical example

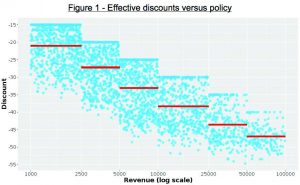

Figure 1 – Effective discounts versus policy

The analysis of actual prices reveals that a limited percentage of contracts (sometimes less than 20%) comply with the discount policy. In the case presented in figure 1, each point represents a contract with its revenue (x axis) and effective discount versus standard tariff (y axis).

Only 17% of contracts are compliant with the discount policy (step blue line). The effective average discount (step red line) is in average 7.4% below the discount

policy. This is pure margin left on the table.

Two types of reasons explain this gap:

- Ineffective control of pricing exceptions and lack of compliance monitoring;

- Discount policy is based on a single factor (revenue) whereas multiple factors drive costs and customers’

willingness to pay.

Two solutions enable to drastically reduce this profit leakage…

This article is an extract from the Winter Edition of MER Magazine published in August 2018. You can read the full article as well as other articles from MER for free by visiting digital.mailandexpressreview.com.